Time is running short on this lovely Monday morning in La Quinta, CA, so I’m going to keep this brief. Cutting to the chase, after enduring several weeks of intense selling, stocks enjoyed a bounce last week. Deeply oversold conditions combined with some good news, for a change, created an environment for buyers to return. The question, of course, is how long Ms. Market’s warm and fuzzy mood will last.

A lot of analysts are calling the recent joyride to the upside a “sigh of relief” rally. This may sound a bit strange to those following the war (oops, I mean “special military operation”) in Ukraine as the human toll being inflicted by Putin’s brutal attack is tragic by any definition.

However, from a market standpoint, there does seem to be “some” hope on the war front (albeit small at this point). The key is both sides now appear to be at least talking about talking – which is often the first step towards achieving some sort of resolution. Yet the bears are quick to point out that a lot can still go wrong – as in very wrong – in this situation. But for now, those seeing the glass as half full like the idea that there might be some hope on the war front.

Investors also got some surprisingly good news on the topic of inflation last week. By now, I’m quite sure everyone on the planet knows that CPI readings recently came in at 40-year highs. However, the reading for the Producer Price Index (PPI), which measures inflation at the producer level, was a tenth below expectations and 0.3% below the January reading. And the so-called “core” reading (which removes those pesky things like food and energy) was reported at 0.2%, which was well below the consensus expectation for 0.6% as well as January’s reading of 1.0%. As such, the idea of “peak inflation” started to make the rounds again last week.

Next up were the reports out of China, which were supportive for markets. With its stock market having been absolutely smoked since early 2021, apparently Beijing had seen enough. So, an official state council vowed to support financial markets by easing regulations and to stimulate the economy. And we all know how markets like governments stimulating their economies!

So, with the world’s 2nd biggest economy expected to get a boost soon, traders decided to buy the dip in China.

The dip-buying mood didn’t stop there as some big-name analysts, including JP Morgan’s Marko Kolanovic, suggested that geopolitical risks should subside at some point soon and as such, it was time to put some risk back on.

And then there is the Fed. Yes, perhaps the most telegraphed rate hike in history finally occurred last week. And yes, Jay Powell’s crew did suggest (via their projections and dot plots) that there are more rate hikes on the way. However, with the futures markets showing that 7 hikes in 2022 have been fully priced in, a sigh of relief wasn’t surprising.

Another way to look at this is that markets now appear to be getting comfy with the Fed’s plan to steadily raise rates in the coming months and quarters. So, again, the fact that the news wasn’t worse allowed traders to “pick their spots” and start buying stocks again.

So, will the rally last? Are prices now appealing enough for investors to scoop up some perceived values? Or was the recent bounce simply a countertrend move that will quickly give way to further downside testing?

Obviously, I don’t have answers here. Nor should anyone be expected to. But after a bounce such as we’ve seen over the last 4 trading days, where we go in the near-term could very well be telling about the intermediate-term picture.

To be clear, I don’t expect to see stocks run right back to their January highs. No, from my seat, a period of backing and filling makes sense as the market seeks the appropriate levels given the outlook for inflation, earnings, and economic growth.

From a near-term perspective, stocks are now overbought and the bulls couldn’t be blamed for taking a break. But the VIX is pulling back, which is a good thing. So, again, we will be watching the near-term action very closely for clues about the next 10% move.

Now let’s review the “state of the market” through the lens of our market models…

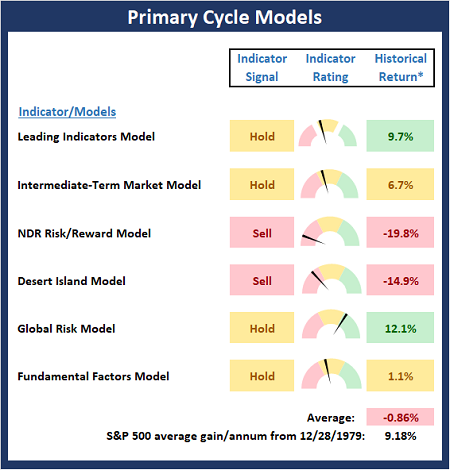

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

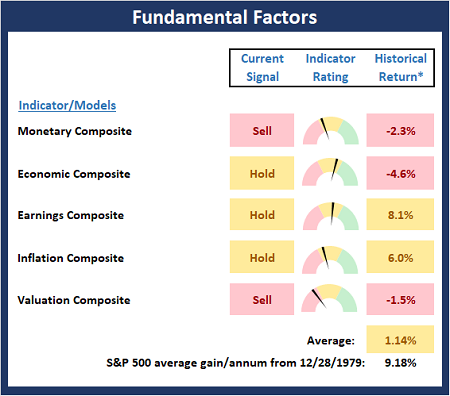

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

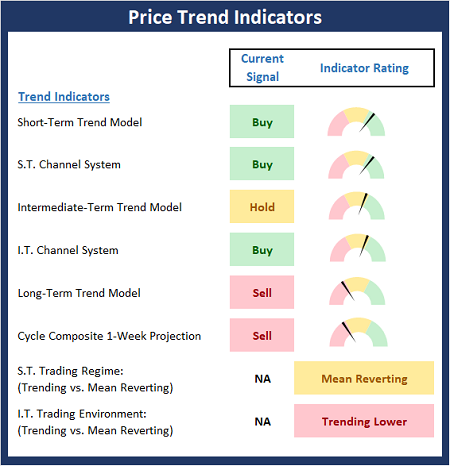

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

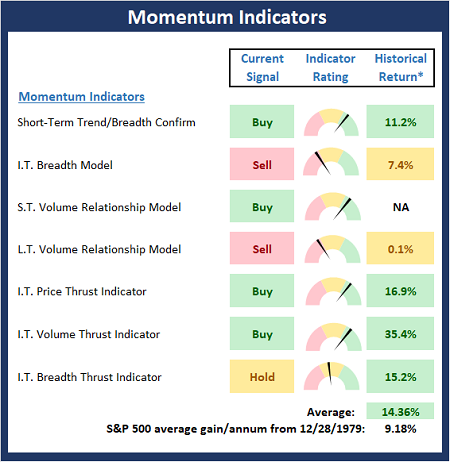

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

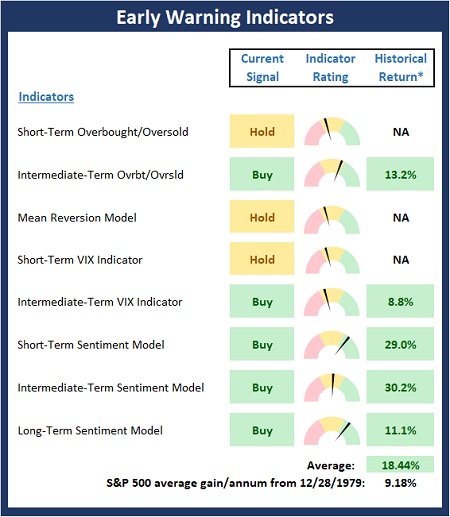

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

There’s none so deaf as those who will not hear. -English Proverb

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

JPM

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Sigh of Relief

Time is running short on this lovely Monday morning in La Quinta, CA, so I’m going to keep this brief. Cutting to the chase, after enduring several weeks of intense selling, stocks enjoyed a bounce last week. Deeply oversold conditions combined with some good news, for a change, created an environment for buyers to return. The question, of course, is how long Ms. Market’s warm and fuzzy mood will last.

A lot of analysts are calling the recent joyride to the upside a “sigh of relief” rally. This may sound a bit strange to those following the war (oops, I mean “special military operation”) in Ukraine as the human toll being inflicted by Putin’s brutal attack is tragic by any definition.

However, from a market standpoint, there does seem to be “some” hope on the war front (albeit small at this point). The key is both sides now appear to be at least talking about talking – which is often the first step towards achieving some sort of resolution. Yet the bears are quick to point out that a lot can still go wrong – as in very wrong – in this situation. But for now, those seeing the glass as half full like the idea that there might be some hope on the war front.

Investors also got some surprisingly good news on the topic of inflation last week. By now, I’m quite sure everyone on the planet knows that CPI readings recently came in at 40-year highs. However, the reading for the Producer Price Index (PPI), which measures inflation at the producer level, was a tenth below expectations and 0.3% below the January reading. And the so-called “core” reading (which removes those pesky things like food and energy) was reported at 0.2%, which was well below the consensus expectation for 0.6% as well as January’s reading of 1.0%. As such, the idea of “peak inflation” started to make the rounds again last week.

Next up were the reports out of China, which were supportive for markets. With its stock market having been absolutely smoked since early 2021, apparently Beijing had seen enough. So, an official state council vowed to support financial markets by easing regulations and to stimulate the economy. And we all know how markets like governments stimulating their economies!

So, with the world’s 2nd biggest economy expected to get a boost soon, traders decided to buy the dip in China.

The dip-buying mood didn’t stop there as some big-name analysts, including JP Morgan’s Marko Kolanovic, suggested that geopolitical risks should subside at some point soon and as such, it was time to put some risk back on.

And then there is the Fed. Yes, perhaps the most telegraphed rate hike in history finally occurred last week. And yes, Jay Powell’s crew did suggest (via their projections and dot plots) that there are more rate hikes on the way. However, with the futures markets showing that 7 hikes in 2022 have been fully priced in, a sigh of relief wasn’t surprising.

Another way to look at this is that markets now appear to be getting comfy with the Fed’s plan to steadily raise rates in the coming months and quarters. So, again, the fact that the news wasn’t worse allowed traders to “pick their spots” and start buying stocks again.

So, will the rally last? Are prices now appealing enough for investors to scoop up some perceived values? Or was the recent bounce simply a countertrend move that will quickly give way to further downside testing?

Obviously, I don’t have answers here. Nor should anyone be expected to. But after a bounce such as we’ve seen over the last 4 trading days, where we go in the near-term could very well be telling about the intermediate-term picture.

To be clear, I don’t expect to see stocks run right back to their January highs. No, from my seat, a period of backing and filling makes sense as the market seeks the appropriate levels given the outlook for inflation, earnings, and economic growth.

From a near-term perspective, stocks are now overbought and the bulls couldn’t be blamed for taking a break. But the VIX is pulling back, which is a good thing. So, again, we will be watching the near-term action very closely for clues about the next 10% move.

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

There’s none so deaf as those who will not hear. -English Proverb

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

JPM

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives