That giant hissing sound you may hear at the corner of Broad and Wall these days is the air escaping the bear camp’s balloon. Cutting to the chase, the bulls now look to be in stampede mode and have been trampling their opponents on a daily basis.

While everybody knows that the current joyride to the upside can’t continue ad infinitum, for those needing to put cash to work, it is beginning to feel like stocks may never retreat again. Ever.

Yes, that last sentence contained a hefty dose of sarcasm. But the bottom line is this is what happens when the bulls get on a roll. Before you can look up the proper spelling of NVIDIA Corp (NVDA) or remember which side of Bitcoin Elon Musk’s Tesla (TSLA) is on, the market darlings explode in what can only be described as a parabolic fashion, leaving any/all doubters in the dust.

Oh, and don’t look now fans, but all of those “reopening” plays are suddenly en fuego. I’ve lost track as to where we are on the exact iteration of this trade, but there can be little doubt that companies whose revenues depend on folks gathering are on a tear.

The question, of course, is why have stocks suddenly caught fire? Why is Wall Street suddenly a one-way street? What happened to all the worry about inflation, rates, covid, and the economy?

From my seat there are a handful of reasons for the current run for the roses.

First, to quote a phrase, “it’s the economy, stupid.” The key here is the street got a bunch of data last week showing that the economy is doing better than had been expected. I won’t bore you with all the reports, but one example is the ISM Non-Manufacturing Index (which details the current “state” of the services sector – which, of course, represents something on the order of two-thirds of the U.S. economy). In short, the report came in above expectations – and at an all-time high.

Speaking of good data, the highlight of the week was the Jobs report. It turns out that all the recent fretting about the labor market may have been misplaced as the total number of new hires (including revisions to the last two months) exceeded expectations. And from my seat, the report can be placed in the Goldilocks category. As in, much better than expected, but not hot enough to worry the Fed.

While on the topic of the Fed, markets appeared to also applaud Jay Powell’s communications this week. The Fed Chair once again looks to have threaded the needle by making it abundantly clear that tapering is a separate issue from rate hikes. And as far as the latter goes, apparently Powell’s merry band of central bankers still isn’t even thinking about thinking about raising rates. And for stocks, this is a good thing.

Then there is the news on the COVID front. In case you missed it, on Friday, Pfizer (PFE) announced that their therapy for COVID patients – which is taken in pill form – reduced hospitalizations and deaths by 89%. So, in a few short weeks, anyone who gets COVID can take a pill. Bam. Game changer.

While Dr. Scott Gottleib, the former head of the FDA, does happen to sit on the Pfizer board and may be talking his book a bit, he seemed to sum up the situation nicely by saying, “This is the end of the pandemic as we know it.” Of course, he was referring to the combination of the new pill and the Administration’s January 4 mandate on vaccinations. But the idea that COVID as we know it could be over in a couple months is definitely encouraging.

Finally, we can stir in the narrative that some of the supply chain problems may be starting to subside. Oh, and word from several chip makers that they are doing just fine, thank you. What you are left with is the reality that two of the market/economy’s headwinds are starting to subside. And since stocks look ahead, not back, well, you get the idea…

So, there you have it. All of the above suggest that we may seeing the beginning of the end of the pandemic and that a real, lasting reopening – aka a return to “normal” if you will, just might be on the horizon. And anyone who doesn’t see this as good news just might be a permabear.

Given the status of the calendar and the FOMO that seems to be in the air, all of the above appears to have combined to produce a breakaway bull mode. And while there will surely be some sort of pause or pullback in the near-term, unless/until the upbeat narrative changes, it is probably best to stay seated on the bull train.

Now let’s turn to our weekly review of the “state of the market” from a model perspective…

The Big-Picture Market Models

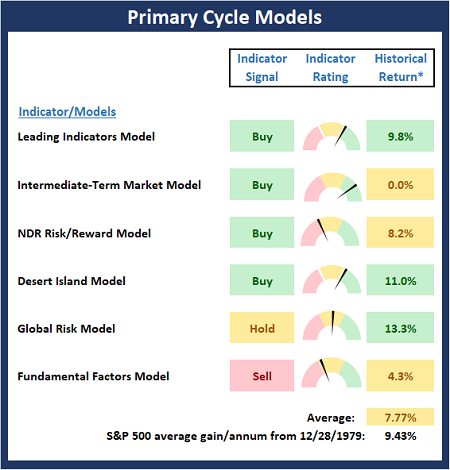

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is one subtle change to Primary Cycle Board this week as the Leading Indicators Model dipped into the neutral zone, albeit by the skinniest of margins. While this change takes the hypothetical historical average return of the S&P 500 given the current modes of the models below the historical mean, the overall message from the big-picture market models remains constructive.

The Fundamental Backdrop

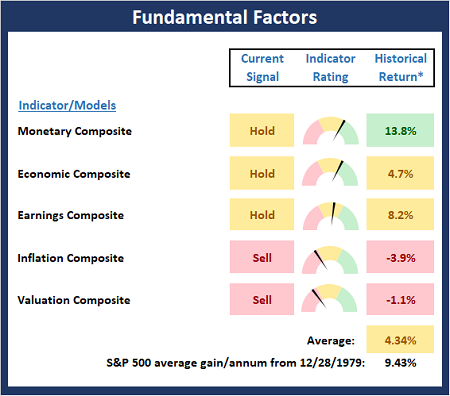

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There are no changes to the Fundamental Board this week. And as I’ve been saying, the fact that there is no green on the board suggests that while the bulls remain in control, this is NOT a low-risk environment.

The State of the Trend

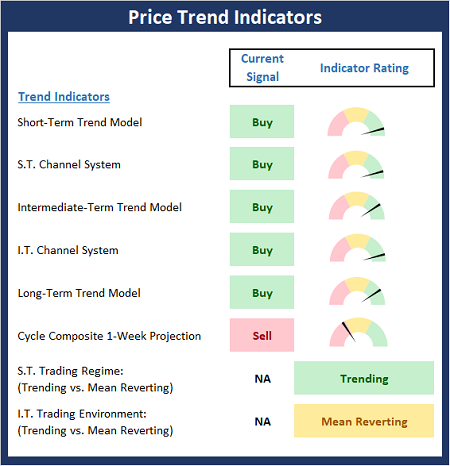

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

With the S&P continuing to make new all-time highs, it isn’t surprising to see the Trend Board sporting so many green boxes. I will note that the Cycle Composite moves to negative for the next two week. However, the rest of the board suggest that the bulls remain in control.

The State of Internal Momentum

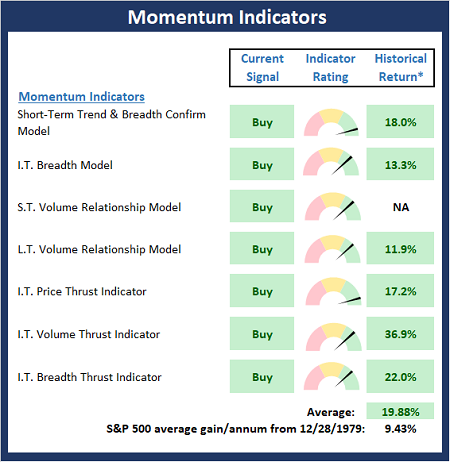

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The good news from a market model perspective is the Momentum Board is now universally green. This suggests there are no divergences to be concerned about and the bulls have some “mo” on their side.

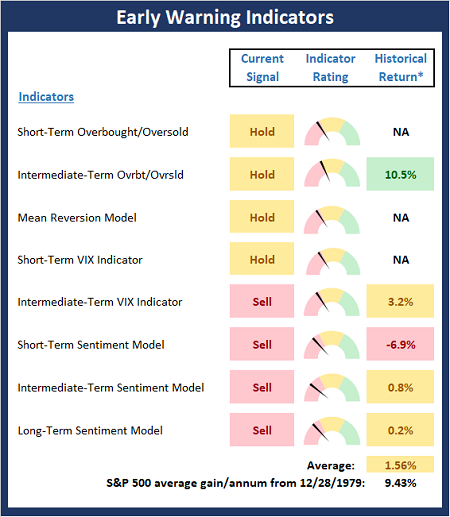

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

However… The Early Warning Board is now clearly in the “get ready for a countertrend move” mode. And while the board can stay in such a state for long periods of time, active investors should be on the lookout for some sort of “go the other way” move in the near-term.

Thought for the Day:

The eye nor the intellect knows what the heart sees. -Unknown

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

NVDA

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Reasons For The Rally

That giant hissing sound you may hear at the corner of Broad and Wall these days is the air escaping the bear camp’s balloon. Cutting to the chase, the bulls now look to be in stampede mode and have been trampling their opponents on a daily basis.

While everybody knows that the current joyride to the upside can’t continue ad infinitum, for those needing to put cash to work, it is beginning to feel like stocks may never retreat again. Ever.

Yes, that last sentence contained a hefty dose of sarcasm. But the bottom line is this is what happens when the bulls get on a roll. Before you can look up the proper spelling of NVIDIA Corp (NVDA) or remember which side of Bitcoin Elon Musk’s Tesla (TSLA) is on, the market darlings explode in what can only be described as a parabolic fashion, leaving any/all doubters in the dust.

Oh, and don’t look now fans, but all of those “reopening” plays are suddenly en fuego. I’ve lost track as to where we are on the exact iteration of this trade, but there can be little doubt that companies whose revenues depend on folks gathering are on a tear.

The question, of course, is why have stocks suddenly caught fire? Why is Wall Street suddenly a one-way street? What happened to all the worry about inflation, rates, covid, and the economy?

From my seat there are a handful of reasons for the current run for the roses.

First, to quote a phrase, “it’s the economy, stupid.” The key here is the street got a bunch of data last week showing that the economy is doing better than had been expected. I won’t bore you with all the reports, but one example is the ISM Non-Manufacturing Index (which details the current “state” of the services sector – which, of course, represents something on the order of two-thirds of the U.S. economy). In short, the report came in above expectations – and at an all-time high.

Speaking of good data, the highlight of the week was the Jobs report. It turns out that all the recent fretting about the labor market may have been misplaced as the total number of new hires (including revisions to the last two months) exceeded expectations. And from my seat, the report can be placed in the Goldilocks category. As in, much better than expected, but not hot enough to worry the Fed.

While on the topic of the Fed, markets appeared to also applaud Jay Powell’s communications this week. The Fed Chair once again looks to have threaded the needle by making it abundantly clear that tapering is a separate issue from rate hikes. And as far as the latter goes, apparently Powell’s merry band of central bankers still isn’t even thinking about thinking about raising rates. And for stocks, this is a good thing.

Then there is the news on the COVID front. In case you missed it, on Friday, Pfizer (PFE) announced that their therapy for COVID patients – which is taken in pill form – reduced hospitalizations and deaths by 89%. So, in a few short weeks, anyone who gets COVID can take a pill. Bam. Game changer.

While Dr. Scott Gottleib, the former head of the FDA, does happen to sit on the Pfizer board and may be talking his book a bit, he seemed to sum up the situation nicely by saying, “This is the end of the pandemic as we know it.” Of course, he was referring to the combination of the new pill and the Administration’s January 4 mandate on vaccinations. But the idea that COVID as we know it could be over in a couple months is definitely encouraging.

Finally, we can stir in the narrative that some of the supply chain problems may be starting to subside. Oh, and word from several chip makers that they are doing just fine, thank you. What you are left with is the reality that two of the market/economy’s headwinds are starting to subside. And since stocks look ahead, not back, well, you get the idea…

So, there you have it. All of the above suggest that we may seeing the beginning of the end of the pandemic and that a real, lasting reopening – aka a return to “normal” if you will, just might be on the horizon. And anyone who doesn’t see this as good news just might be a permabear.

Given the status of the calendar and the FOMO that seems to be in the air, all of the above appears to have combined to produce a breakaway bull mode. And while there will surely be some sort of pause or pullback in the near-term, unless/until the upbeat narrative changes, it is probably best to stay seated on the bull train.

Now let’s turn to our weekly review of the “state of the market” from a model perspective…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is one subtle change to Primary Cycle Board this week as the Leading Indicators Model dipped into the neutral zone, albeit by the skinniest of margins. While this change takes the hypothetical historical average return of the S&P 500 given the current modes of the models below the historical mean, the overall message from the big-picture market models remains constructive.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There are no changes to the Fundamental Board this week. And as I’ve been saying, the fact that there is no green on the board suggests that while the bulls remain in control, this is NOT a low-risk environment.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

With the S&P continuing to make new all-time highs, it isn’t surprising to see the Trend Board sporting so many green boxes. I will note that the Cycle Composite moves to negative for the next two week. However, the rest of the board suggest that the bulls remain in control.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The good news from a market model perspective is the Momentum Board is now universally green. This suggests there are no divergences to be concerned about and the bulls have some “mo” on their side.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

However… The Early Warning Board is now clearly in the “get ready for a countertrend move” mode. And while the board can stay in such a state for long periods of time, active investors should be on the lookout for some sort of “go the other way” move in the near-term.

Thought for the Day:

The eye nor the intellect knows what the heart sees. -Unknown

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

NVDA

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives