If there is anything I’ve learned in my 35+ years of managing money for a living it is that markets HATE uncertainty – especially when it comes to the macroeconomic outlook. And I think it is safe to say that the extreme uncertainty surrounding the outlooks for inflation, interest rates, the economy, and earnings that is responsible for this year’s bear market environment.

In short, the Fed’s fight against inflation caused investors to worry about growth. Or in this case, the distinct possibility for a lack thereof from both the global economy and corporate earnings. As a result, stock prices, which tend to be a discounting mechanism for future expectations, moved lower.

At one point (October 12, 2022, to be exact), the S&P 500 found itself -25.4% below its January 3, 2022, all-time high. I think most will agree that this represents a pretty hefty amount of “discounting” for those future expectations. (And yes, I will agree that stock prices were more than a little “stretched” to the upside at their peak when you consider historical valuation measures.)

The question at times like these is, how much is enough? As in, how much of a decline in stock prices is needed to sufficiently discount the outlook for the future?

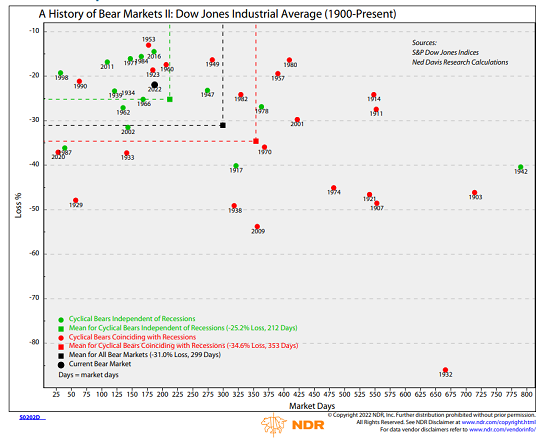

Granted, the ultimate answer here lies in the eyes of the beholder. But sometimes it is a good idea to look back at history for clues. So, let’s take a look at the analysis from Ned Davis Research Group of all bear markets since 1900.

Cutting to the chase, what NDR found was that the degree of damage caused by a given bear can be classified into two different categories: Those bears that were accompanied by a recession and those that weren’t.

View Chart Online

Image Source: Ned Davis Research Group

As the chart indicates, the average decline for bear markets that are accompanied by a recession in the U.S., is -34.6%, or about 20% lower from current prices. This suggests that the market has not “discounted” the possibility of the economy entering a full-blown recession.

At the same time, we should note that the average bear market that is NOT accompanied by a recession has produced losses of -25.2%. So, again, using history as our guide, IF the economy can avoid a recession, it is easy to argue that the low seen in October (at -25.4%) could represent a sufficient degree of discounting.

Before we proceed any further, let’s take a moment to review the definition of a recession. As defined by NBER (the official keepers of the dates when recessions begin and end) recessions are a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. In other words, it is important to remember that a recession is NOT simply two consecutive quarters of negative GDP growth. No, we’re talking about a “real” recession here, not what folks like to call a “technical” recession.

So, IF the economy is going to experience a full-blown recession, then there is likely more pain to come. Conversely, if the economy can avoid a meaningful decline in activity, then history suggests that we might be able to start looking ahead to better days. You know, when inflation returns to more normal levels and the Fed backs off.

Place Your Bets

From my seat, the question of recession becomes the most important issue of 2023. At least at this point in time, the answer is, well, uncertain. And this, dear readers, is the reason why stocks appear to be struggling mightily at the present time.

With the key question defined, investors of all shapes and sizes now need to take a stand and place their bets (i.e. position their portfolios) accordingly. If you think the economy will “land softly” from the elevated inflation situation, then by all means, you should be long stocks and be looking to add on the dips.

However, if you believe the economy is about to take a serious turn for the worse, then you’d best take cover in order to avoid the pain that is likely ahead.

Which Is It?

Long-time readers of my oftentimes meandering market missive will recall that I do not – and am unlikely to ever manage money based on my outlook, views, hunches, tips, or even phases of the moon. No, I’ve been able to stay in Ms. Market’s game this long by relying on unemotional models designed to keep me in tune with what IS happening in the markets – not what I think “should be” happening in the markets.

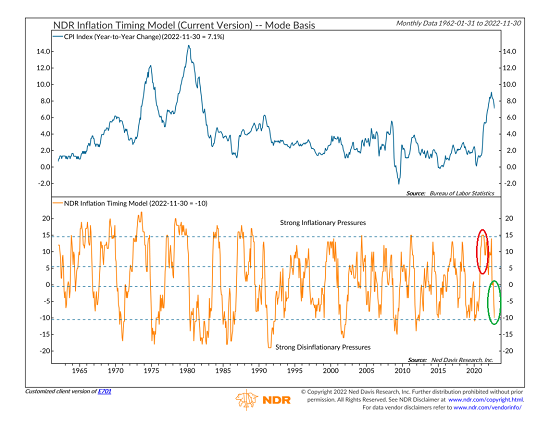

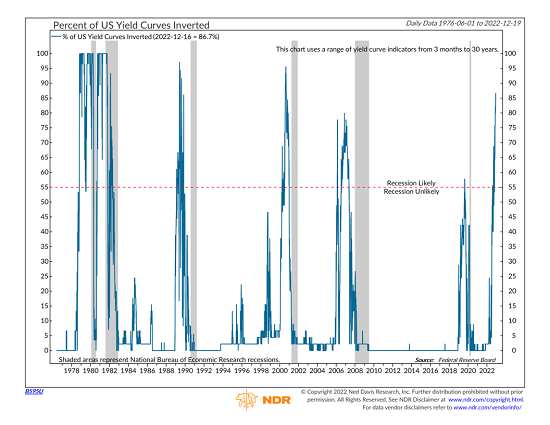

At the present time, my models are providing an abundance of information/messaging, some good, some bad. For example, a review of my macro models shows that (a) inflationary pressures are declining significantly (a good thing – see first chart below), (b) the majority of the yield curves are heavily inverted (an historically bad omen for the economy – see next chart below), (c) the overall economy is slowing (not good), (d) the services sector is “doing just fine, thank you” (insert thumbs up emoji here), (e) the job market remains strong (another thumbs up), and (f) both consumer and corporate balance sheets are in good shape.

View Chart Online

Image Source: Ned Davis Research Group

View Chart Online

Image Source: Ned Davis Research Group

Frankly, the overall message from these models/indicators seems to be fairly positive. However, there are no shortage of indicators telling us a recession is coming including those inverted yield curves, a Regional Fed Indicator model, the Philly Fed State Diffusion Index, and the LEI readings. In sum, there can be little argument that these indicators – all of which have strong records – tell us a recession is on its way.

In addition, the most recent economic data including retail sales and the S&P Global’s Flash PMIs were viewed as worrisome. So, after Fed Chair Powell provided a more hawkish outlook on Wednesday, it’s little wonder that traders moved to a “risk-off” mode last week.

However… From a big-picture standpoint, it seems that the strength of the jobs market, the state of the services sector, and all that cash in the bank is the stuff that soft landings are made of.

A Matter of Timing

So, for me, the issue at hand is one of timing. IF (note the use of all caps) inflation can come down enough for the Fed to back off in a timely fashion (which I will define as the next 3-4 months), then my base case is a “soft landing” for the economy.

In this scenario, I would be looking for opportunities to put money to work into any weakness from now until early spring.

But… You knew, that was coming, right? IF inflation remains elevated and/or the Fed decides to get stubborn and remain antagonistic for an extended period of time, those recession indicators (which tend to have long lead times) could wind up being right after all.

From my perch, the key to the game in the coming months boils down to timing. The inflation internals appear to be going in the right direction and it is primarily rents (which have a lagged effect on the inflation index) keeping CPI high. But this too shall pass (in time) as rents are now starting to fall.

So, the bottom line is that there is still a great deal of uncertainty about the future. And until that uncertainty can be resolved, the stock market is likely to remain volatile and susceptible to data/headlines.

Publishing Note: I will be putting away the keyboard until after the New Year. Happy Holidays!

Now let’s review the “state of the market” through the lens of our market models…

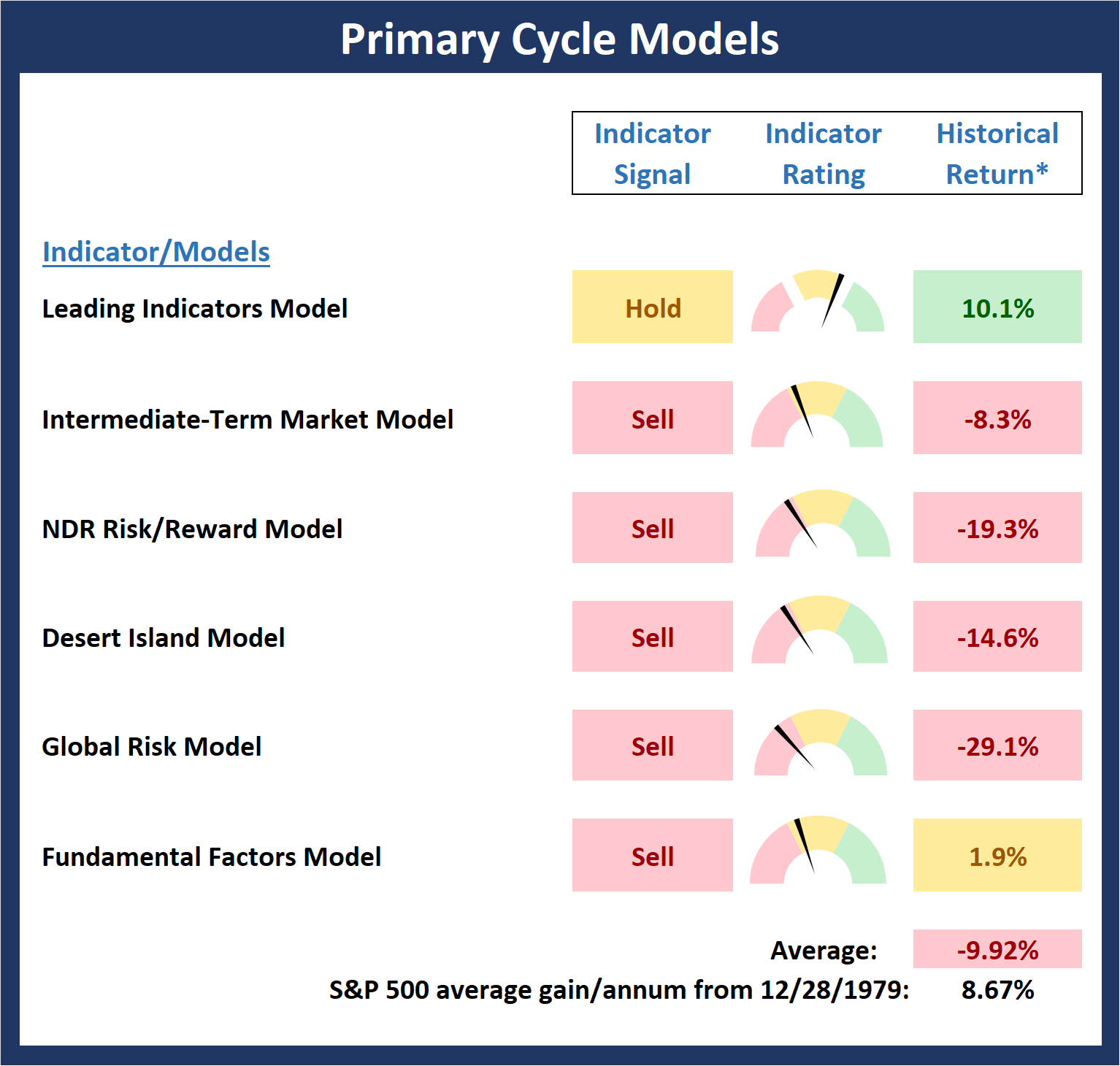

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

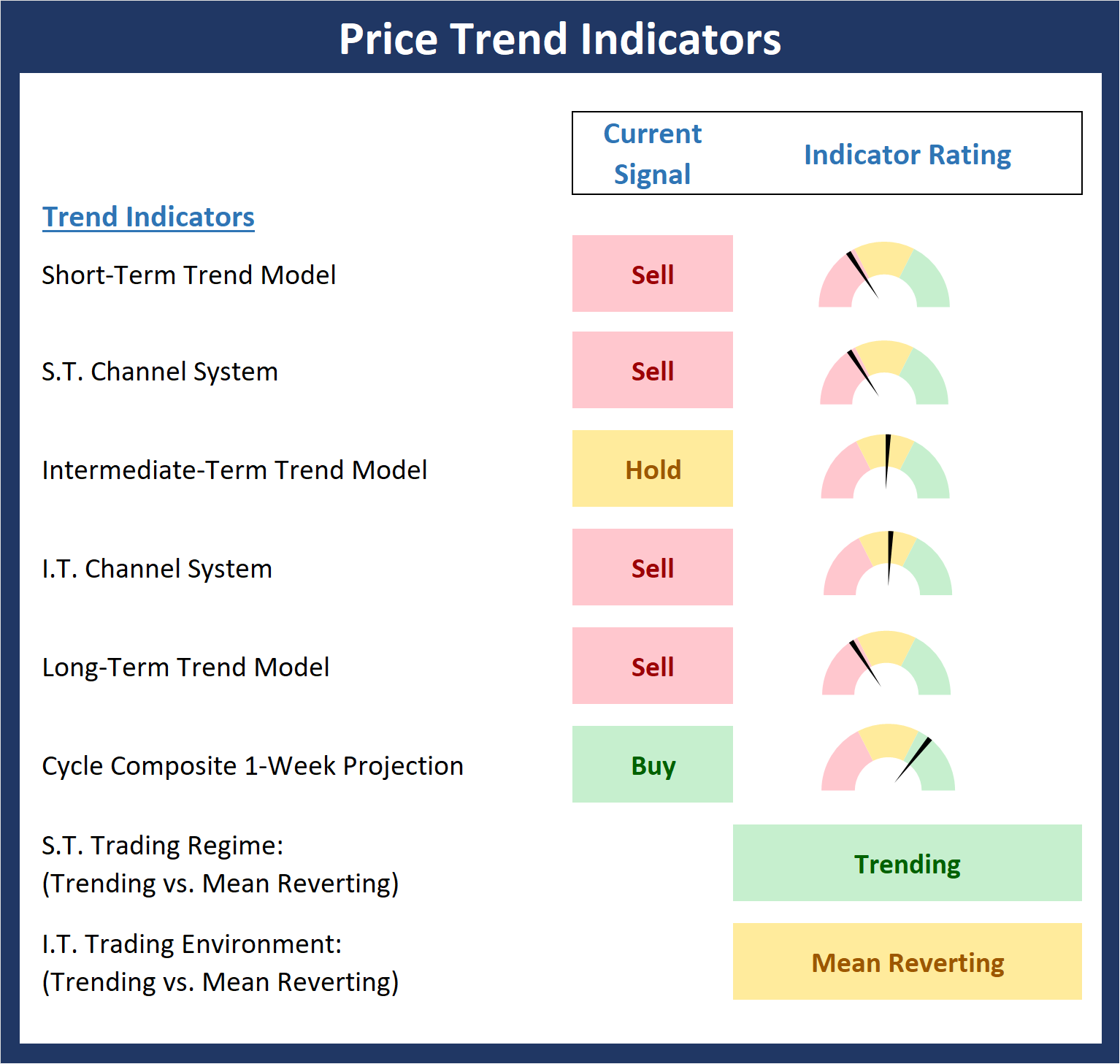

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Key Price Levels

- S&P 500 Near-Term Support Zone: 3802

- S&P 500 Near-Term Resistance Zone: 3920

- S&P 500 50-day Simple MA: 3863

- S&P 500 200-day Simple MA: 4027

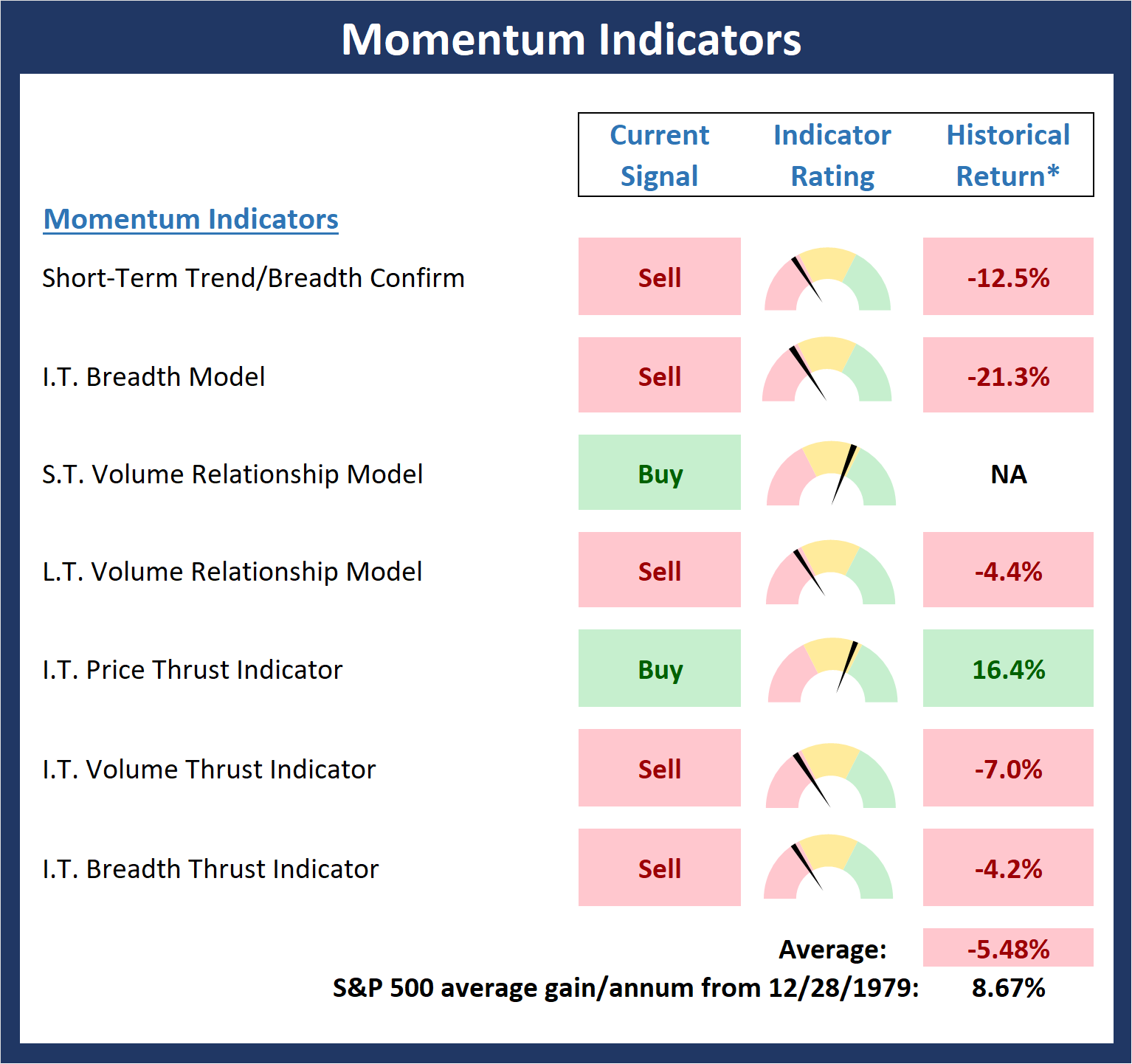

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

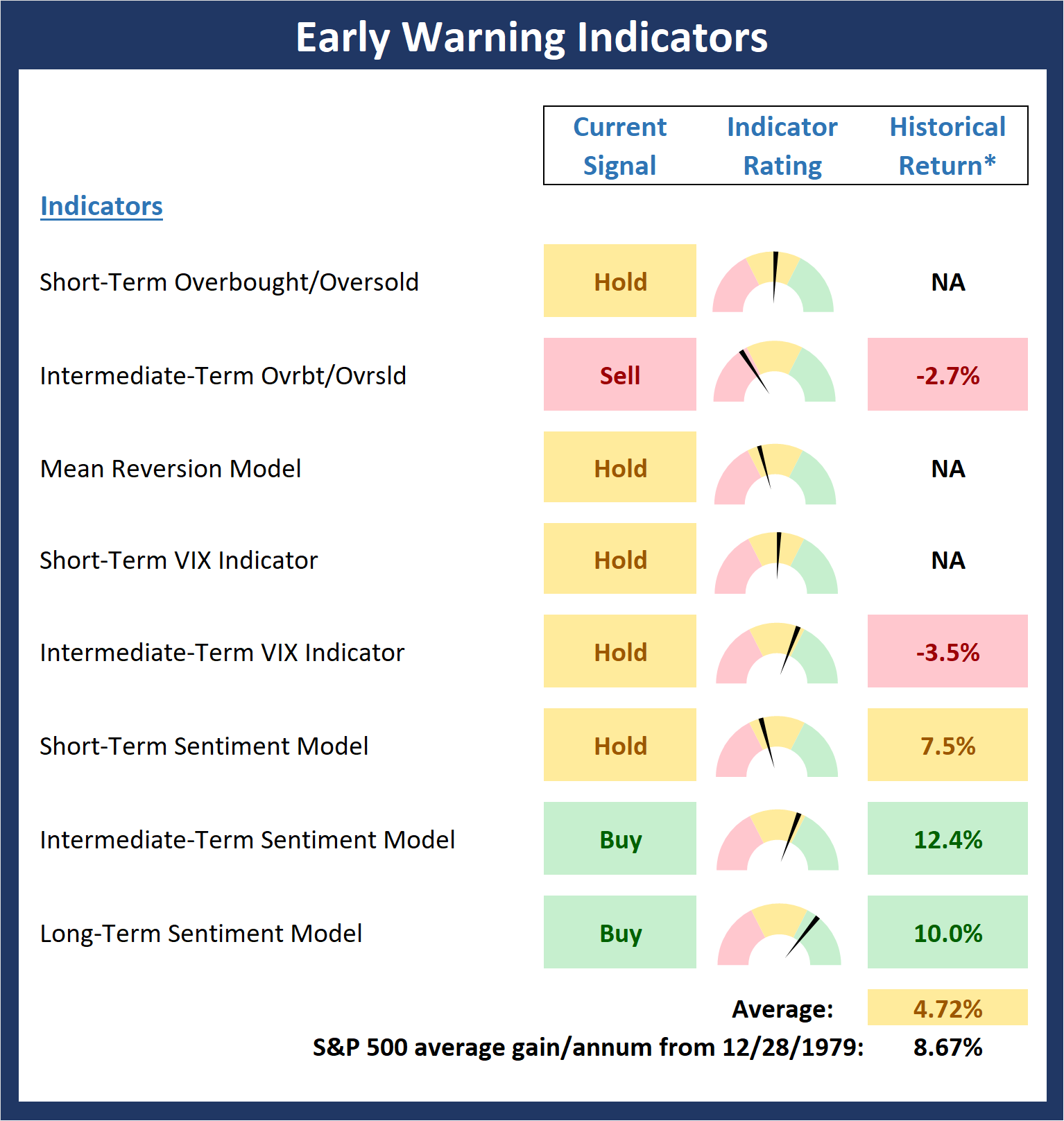

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

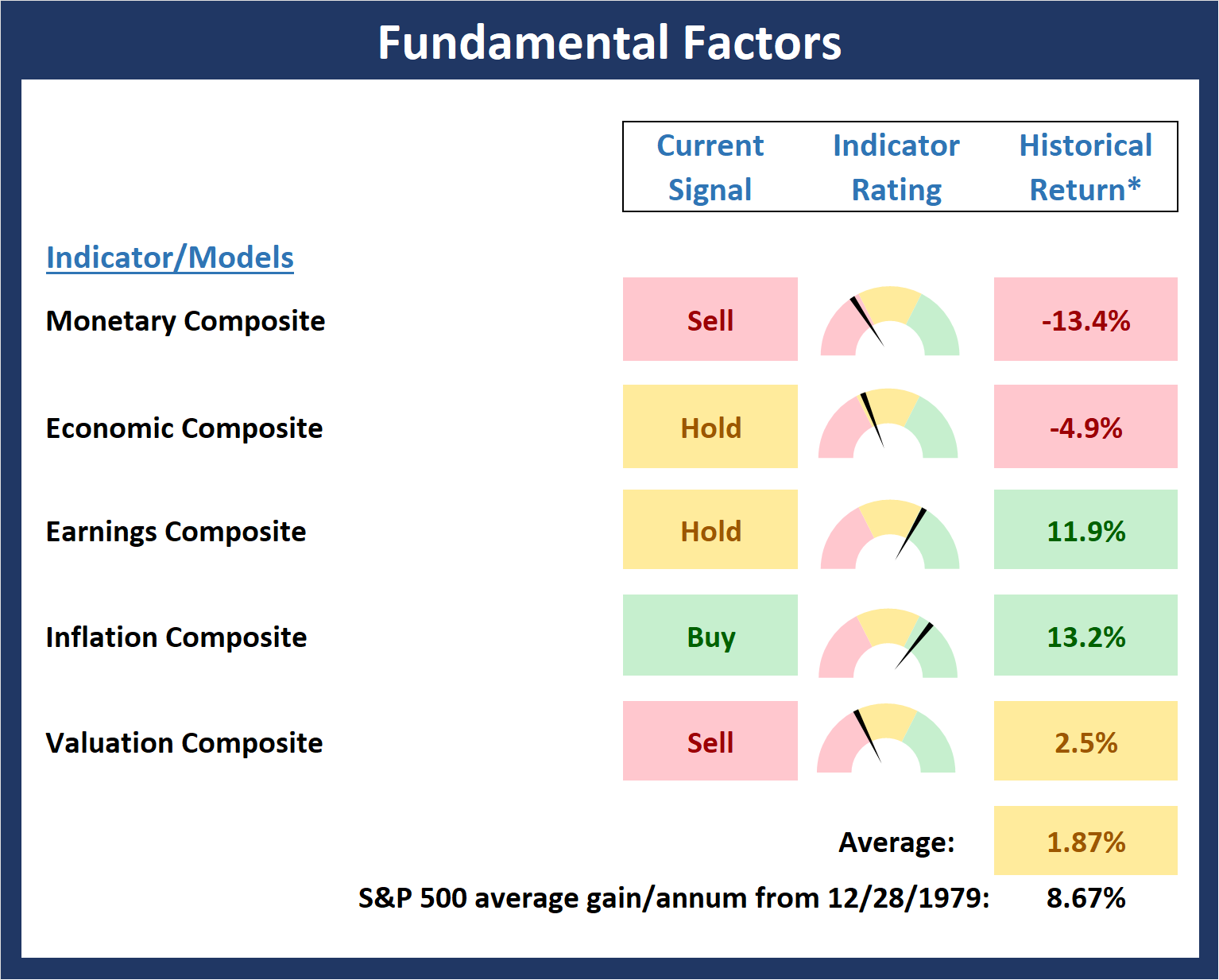

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Everything that can be counted does not necessarily count; everything that counts cannot necessarily be counted. -Albert Einstein

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

Institutional Consulting

David Moenning

Place Your Bets

If there is anything I’ve learned in my 35+ years of managing money for a living it is that markets HATE uncertainty – especially when it comes to the macroeconomic outlook. And I think it is safe to say that the extreme uncertainty surrounding the outlooks for inflation, interest rates, the economy, and earnings that is responsible for this year’s bear market environment.

In short, the Fed’s fight against inflation caused investors to worry about growth. Or in this case, the distinct possibility for a lack thereof from both the global economy and corporate earnings. As a result, stock prices, which tend to be a discounting mechanism for future expectations, moved lower.

At one point (October 12, 2022, to be exact), the S&P 500 found itself -25.4% below its January 3, 2022, all-time high. I think most will agree that this represents a pretty hefty amount of “discounting” for those future expectations. (And yes, I will agree that stock prices were more than a little “stretched” to the upside at their peak when you consider historical valuation measures.)

The question at times like these is, how much is enough? As in, how much of a decline in stock prices is needed to sufficiently discount the outlook for the future?

Granted, the ultimate answer here lies in the eyes of the beholder. But sometimes it is a good idea to look back at history for clues. So, let’s take a look at the analysis from Ned Davis Research Group of all bear markets since 1900.

Cutting to the chase, what NDR found was that the degree of damage caused by a given bear can be classified into two different categories: Those bears that were accompanied by a recession and those that weren’t.

View Chart Online

Image Source: Ned Davis Research Group

As the chart indicates, the average decline for bear markets that are accompanied by a recession in the U.S., is -34.6%, or about 20% lower from current prices. This suggests that the market has not “discounted” the possibility of the economy entering a full-blown recession.

At the same time, we should note that the average bear market that is NOT accompanied by a recession has produced losses of -25.2%. So, again, using history as our guide, IF the economy can avoid a recession, it is easy to argue that the low seen in October (at -25.4%) could represent a sufficient degree of discounting.

Before we proceed any further, let’s take a moment to review the definition of a recession. As defined by NBER (the official keepers of the dates when recessions begin and end) recessions are a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. In other words, it is important to remember that a recession is NOT simply two consecutive quarters of negative GDP growth. No, we’re talking about a “real” recession here, not what folks like to call a “technical” recession.

So, IF the economy is going to experience a full-blown recession, then there is likely more pain to come. Conversely, if the economy can avoid a meaningful decline in activity, then history suggests that we might be able to start looking ahead to better days. You know, when inflation returns to more normal levels and the Fed backs off.

Place Your Bets

From my seat, the question of recession becomes the most important issue of 2023. At least at this point in time, the answer is, well, uncertain. And this, dear readers, is the reason why stocks appear to be struggling mightily at the present time.

With the key question defined, investors of all shapes and sizes now need to take a stand and place their bets (i.e. position their portfolios) accordingly. If you think the economy will “land softly” from the elevated inflation situation, then by all means, you should be long stocks and be looking to add on the dips.

However, if you believe the economy is about to take a serious turn for the worse, then you’d best take cover in order to avoid the pain that is likely ahead.

Which Is It?

Long-time readers of my oftentimes meandering market missive will recall that I do not – and am unlikely to ever manage money based on my outlook, views, hunches, tips, or even phases of the moon. No, I’ve been able to stay in Ms. Market’s game this long by relying on unemotional models designed to keep me in tune with what IS happening in the markets – not what I think “should be” happening in the markets.

At the present time, my models are providing an abundance of information/messaging, some good, some bad. For example, a review of my macro models shows that (a) inflationary pressures are declining significantly (a good thing – see first chart below), (b) the majority of the yield curves are heavily inverted (an historically bad omen for the economy – see next chart below), (c) the overall economy is slowing (not good), (d) the services sector is “doing just fine, thank you” (insert thumbs up emoji here), (e) the job market remains strong (another thumbs up), and (f) both consumer and corporate balance sheets are in good shape.

View Chart Online

Image Source: Ned Davis Research Group

View Chart Online

Image Source: Ned Davis Research Group

Frankly, the overall message from these models/indicators seems to be fairly positive. However, there are no shortage of indicators telling us a recession is coming including those inverted yield curves, a Regional Fed Indicator model, the Philly Fed State Diffusion Index, and the LEI readings. In sum, there can be little argument that these indicators – all of which have strong records – tell us a recession is on its way.

In addition, the most recent economic data including retail sales and the S&P Global’s Flash PMIs were viewed as worrisome. So, after Fed Chair Powell provided a more hawkish outlook on Wednesday, it’s little wonder that traders moved to a “risk-off” mode last week.

However… From a big-picture standpoint, it seems that the strength of the jobs market, the state of the services sector, and all that cash in the bank is the stuff that soft landings are made of.

A Matter of Timing

So, for me, the issue at hand is one of timing. IF (note the use of all caps) inflation can come down enough for the Fed to back off in a timely fashion (which I will define as the next 3-4 months), then my base case is a “soft landing” for the economy.

In this scenario, I would be looking for opportunities to put money to work into any weakness from now until early spring.

But… You knew, that was coming, right? IF inflation remains elevated and/or the Fed decides to get stubborn and remain antagonistic for an extended period of time, those recession indicators (which tend to have long lead times) could wind up being right after all.

From my perch, the key to the game in the coming months boils down to timing. The inflation internals appear to be going in the right direction and it is primarily rents (which have a lagged effect on the inflation index) keeping CPI high. But this too shall pass (in time) as rents are now starting to fall.

So, the bottom line is that there is still a great deal of uncertainty about the future. And until that uncertainty can be resolved, the stock market is likely to remain volatile and susceptible to data/headlines.

Publishing Note: I will be putting away the keyboard until after the New Year. Happy Holidays!

Now let’s review the “state of the market” through the lens of our market models…

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Key Price Levels

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Everything that can be counted does not necessarily count; everything that counts cannot necessarily be counted. -Albert Einstein

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives