As a reminder I’ve decided to make an adjustment to the publishing schedule of my blog/oftentimes meandering market missive. Going forward, the plan is to publish a “Model Review” report on Monday mornings. This will be the same group of models that you have come to know over the years. The idea is to start the week with a quick check on the key market models/indicator boards.

At the request of clients, we have added a section to each model board describing any important changes and our overall take on the board.

In addition, I will strive to provide our view of the primary market drivers (aka, “The State of the Market” report) in a separate post, as time permits – this post is planned for mid-week.

Now let’s get the new week started with a review the “state of the market” from a modeling perspective…

The Big-Picture Market Models

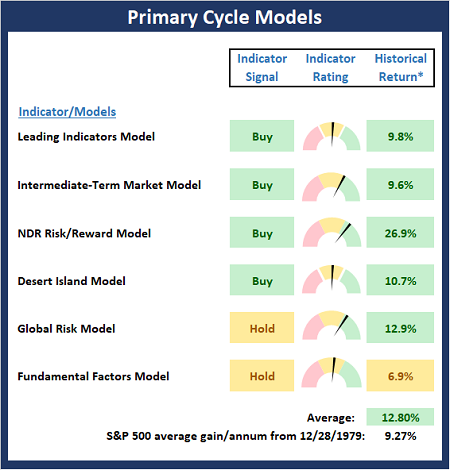

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

The Primary Cycle Board sports modest improvement this week as the NDR Risk/Reward model upticked a bit, as the hypothetical historical return of the S&P 500 when the model is in its current state improved from 7.9% to 26.9%. This pushes the overall hypo historical average return up to 12.8%. Bottom Line: My favorite big-picture market models tell me to continue to lean bullish.

The Fundamental Backdrop

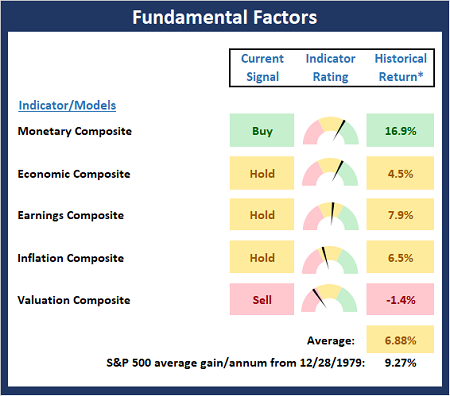

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There was no change to the Fundamental Board this week. Bottom Line: The board reminds us that while the bulls remain in control, this is not a low-risk environment as there are “issues” with several models and valuations remain flat-out negative.

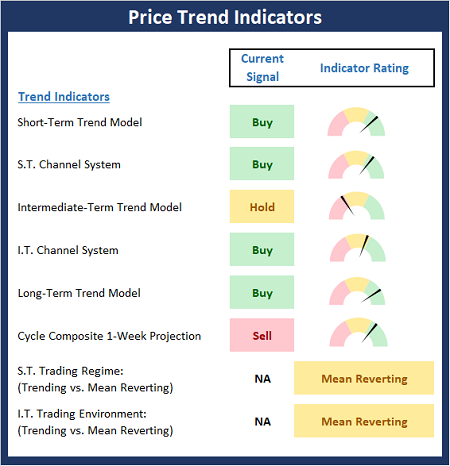

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

There was some marked improvement in the Trend Board this week as the Short-Term Trend and Channel System indicators moved back into the green. However, the Cycle Composite suggests there could be additional weakness ahead. Bottom Line: The board indicates the bulls are attempting a comeback after the first 5% correction in quite some time.

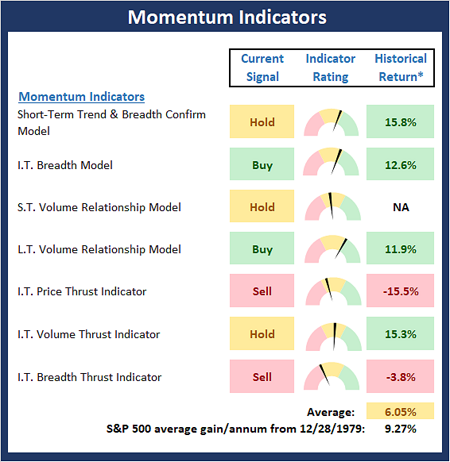

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The Momentum Board remains a mixed bag this week. Whereas the Short-Term Trend & Breadth and Volume and Channel System indicators moved from negative to neutral, the Intermediate-Term Breadth Thrust indicator fell into the red. Bottom Line: The board suggests the bulls have some work to do in the momentum department if they have eyes on a new uptrend.

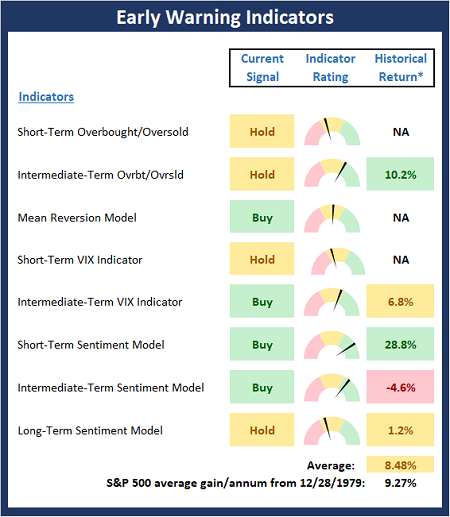

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

There was little change to the Early Warning Board this week. Bottom Line: The board suggests the bulls have the edge at the moment as they continue the rebound attempt.

Thought for the Day:

You are neither right nor wrong because people agree with you. -Warren Buffett

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Market Model Review 10.11.21

As a reminder I’ve decided to make an adjustment to the publishing schedule of my blog/oftentimes meandering market missive. Going forward, the plan is to publish a “Model Review” report on Monday mornings. This will be the same group of models that you have come to know over the years. The idea is to start the week with a quick check on the key market models/indicator boards.

At the request of clients, we have added a section to each model board describing any important changes and our overall take on the board.

In addition, I will strive to provide our view of the primary market drivers (aka, “The State of the Market” report) in a separate post, as time permits – this post is planned for mid-week.

Now let’s get the new week started with a review the “state of the market” from a modeling perspective…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

The Primary Cycle Board sports modest improvement this week as the NDR Risk/Reward model upticked a bit, as the hypothetical historical return of the S&P 500 when the model is in its current state improved from 7.9% to 26.9%. This pushes the overall hypo historical average return up to 12.8%. Bottom Line: My favorite big-picture market models tell me to continue to lean bullish.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There was no change to the Fundamental Board this week. Bottom Line: The board reminds us that while the bulls remain in control, this is not a low-risk environment as there are “issues” with several models and valuations remain flat-out negative.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

There was some marked improvement in the Trend Board this week as the Short-Term Trend and Channel System indicators moved back into the green. However, the Cycle Composite suggests there could be additional weakness ahead. Bottom Line: The board indicates the bulls are attempting a comeback after the first 5% correction in quite some time.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The Momentum Board remains a mixed bag this week. Whereas the Short-Term Trend & Breadth and Volume and Channel System indicators moved from negative to neutral, the Intermediate-Term Breadth Thrust indicator fell into the red. Bottom Line: The board suggests the bulls have some work to do in the momentum department if they have eyes on a new uptrend.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

There was little change to the Early Warning Board this week. Bottom Line: The board suggests the bulls have the edge at the moment as they continue the rebound attempt.

Thought for the Day:

You are neither right nor wrong because people agree with you. -Warren Buffett

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives