Traders appear to have returned to a risk-off mode to start the holiday-shortened week. The drivers of the move are fairly obvious as Senator Manchin’s announcement that he won’t support the Biden “Build Back Better” plan and the bad news surrounding Omicron are causing a rethink of the previously optimistic economic view going forward.

A prime example of the current mood is the most recent note from Goldman Sachs (GS). The firm’s chief economist, Jan Hatzius, suggested that the failure of the bill, which was slated to generate a couple trillion in spending on climate and social programs, is likely to slow economic growth in the first quarter. In response, Goldman dropped their GDP growth forecasts for each of the first three quarters of 2022. The firm now is looking for a 2% annualized growth rate in the first quarter, 3% in the second, and 2.75% in the third. Down from 3%, 3.5%, and 3% respectively. Oh, and a far cry from (as in less than half) the current robust growth rates the economy has been enjoying.

In short, it appears the stimulus punch bowl is being pulled from the stock market party. Instead of a friendly Fed that just a month ago was expected to be there to support the economy almost indefinitely, we now have a Fed that is fretting over inflation, a more rapid taper, and rates rising sooner. And instead of more even money being spent in Washington, you have infighting and delay. With the end result being no new stimulus in the near-term. And lest we forget folks, it’s money that makes the world go round in the market game.

Next, we can add in the disturbing Omicron numbers to this mix of worries, which already includes surging inflation and the Powell pivot. What traders and their high-speed trading algos are left with are reasons to take sell, hedge, or just take some chips off the table. So, with all the computers making the same move at the same time, you are left with a “whoosh” lower.

So much for Santa coming to town this week, right?

The good news is we’ve seen this movie before. And so far at least, the hero doesn’t die in the end. So, until we get clarity on how much impact Omicron is going to have on the economy and corporate earnings, it looks like stocks have some “price exploration” to the downside to deal with. This is what “corrections” are all about. And based on today’s action, it appears this is what we’ve got going on right now.

How low will prices go? Only the computers know for sure. But my take is traders will be searching for an equilibrium level that reflects the latest, less optimistic outlook.

Looking at my blinking screens, my take is a key test will be the early December lows just below 4500 on the S&P 500. My guess is this will be an area that could easily act like a magnet for prices – and a logical spot for the bulls to try and make a stand.

But, on the other hand, I see this as a news-driven environment. So, given the drubbing that is occurring this morning, we shouldn’t be surprised to see a joyride to the upside when the news improves.

Finally, I try to take some time away from the keyboard at this time of year to spend more time with the family and to recharge the batteries a bit. So, until 2022 gets underway, here’s wishing everyone Happy Holidays and a Happy, Healthy, and Prosperous New Year!

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

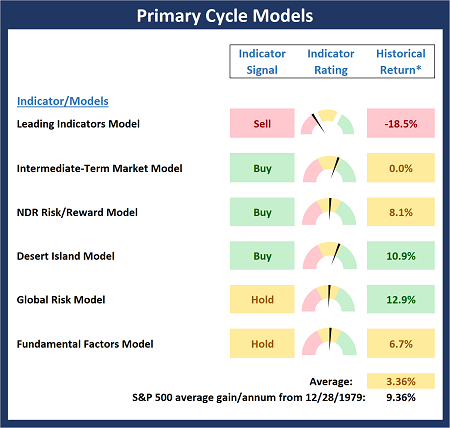

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is no change to the Primary Cycle Board this week. My take is the board leans bullish, but not by a large margin. Put another way, it’s a bull market until proven otherwise.

The Fundamental Backdrop

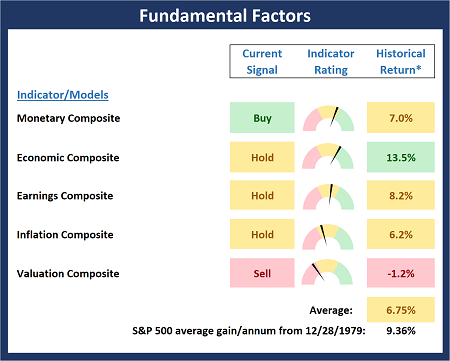

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There is a change to report on the Fundamental Board this week. While it may sound surprising given all the bad news on this front, the Inflation Composite upticked from negative to neutral (albeit to low neutral). Recall that this indicator tends to be early and did a fine job warning us of the increase coming in inflation last year. Thus, my take is the model is telling us that the peak in inflation has likely occurred.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

The Trend Board slipped a bit this week but continues to lean bullish due to the intermediate-term indicators remaining in good shape. Note that the traditional Santa/Year End rally period starts now.

The State of Internal Momentum

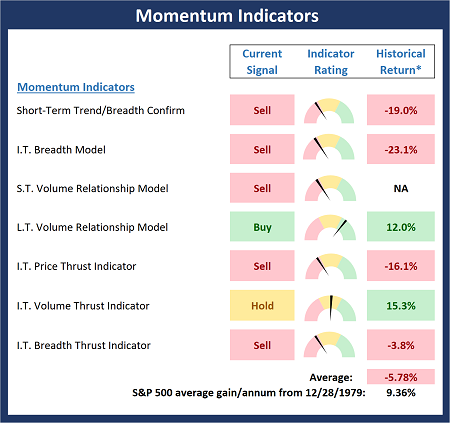

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

As I mentioned last week, the bad news is the Momentum Board is NOT in good shape. My take is the divergence seen between price and momentum should be viewed as a warning. One can argue that some of this can be attributed to year-end tax selling. But the advantage goes to the bears for now.

Early Warning Indicators

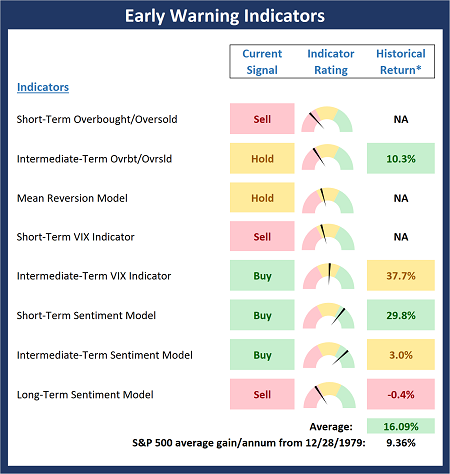

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

The Early Warning Board is fairly neutral here with neither team holding a significant edge.

Thought for the Day:

People of accomplishment rarely sat back and let things happen to them. They went out and happened to things. -Leonardo Da Vinci

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

GS

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Market Getting Moody

Traders appear to have returned to a risk-off mode to start the holiday-shortened week. The drivers of the move are fairly obvious as Senator Manchin’s announcement that he won’t support the Biden “Build Back Better” plan and the bad news surrounding Omicron are causing a rethink of the previously optimistic economic view going forward.

A prime example of the current mood is the most recent note from Goldman Sachs (GS). The firm’s chief economist, Jan Hatzius, suggested that the failure of the bill, which was slated to generate a couple trillion in spending on climate and social programs, is likely to slow economic growth in the first quarter. In response, Goldman dropped their GDP growth forecasts for each of the first three quarters of 2022. The firm now is looking for a 2% annualized growth rate in the first quarter, 3% in the second, and 2.75% in the third. Down from 3%, 3.5%, and 3% respectively. Oh, and a far cry from (as in less than half) the current robust growth rates the economy has been enjoying.

In short, it appears the stimulus punch bowl is being pulled from the stock market party. Instead of a friendly Fed that just a month ago was expected to be there to support the economy almost indefinitely, we now have a Fed that is fretting over inflation, a more rapid taper, and rates rising sooner. And instead of more even money being spent in Washington, you have infighting and delay. With the end result being no new stimulus in the near-term. And lest we forget folks, it’s money that makes the world go round in the market game.

Next, we can add in the disturbing Omicron numbers to this mix of worries, which already includes surging inflation and the Powell pivot. What traders and their high-speed trading algos are left with are reasons to take sell, hedge, or just take some chips off the table. So, with all the computers making the same move at the same time, you are left with a “whoosh” lower.

So much for Santa coming to town this week, right?

The good news is we’ve seen this movie before. And so far at least, the hero doesn’t die in the end. So, until we get clarity on how much impact Omicron is going to have on the economy and corporate earnings, it looks like stocks have some “price exploration” to the downside to deal with. This is what “corrections” are all about. And based on today’s action, it appears this is what we’ve got going on right now.

How low will prices go? Only the computers know for sure. But my take is traders will be searching for an equilibrium level that reflects the latest, less optimistic outlook.

Looking at my blinking screens, my take is a key test will be the early December lows just below 4500 on the S&P 500. My guess is this will be an area that could easily act like a magnet for prices – and a logical spot for the bulls to try and make a stand.

But, on the other hand, I see this as a news-driven environment. So, given the drubbing that is occurring this morning, we shouldn’t be surprised to see a joyride to the upside when the news improves.

Finally, I try to take some time away from the keyboard at this time of year to spend more time with the family and to recharge the batteries a bit. So, until 2022 gets underway, here’s wishing everyone Happy Holidays and a Happy, Healthy, and Prosperous New Year!

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is no change to the Primary Cycle Board this week. My take is the board leans bullish, but not by a large margin. Put another way, it’s a bull market until proven otherwise.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There is a change to report on the Fundamental Board this week. While it may sound surprising given all the bad news on this front, the Inflation Composite upticked from negative to neutral (albeit to low neutral). Recall that this indicator tends to be early and did a fine job warning us of the increase coming in inflation last year. Thus, my take is the model is telling us that the peak in inflation has likely occurred.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Current Take: Trend Models

The Trend Board slipped a bit this week but continues to lean bullish due to the intermediate-term indicators remaining in good shape. Note that the traditional Santa/Year End rally period starts now.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

As I mentioned last week, the bad news is the Momentum Board is NOT in good shape. My take is the divergence seen between price and momentum should be viewed as a warning. One can argue that some of this can be attributed to year-end tax selling. But the advantage goes to the bears for now.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

The Early Warning Board is fairly neutral here with neither team holding a significant edge.

Thought for the Day:

People of accomplishment rarely sat back and let things happen to them. They went out and happened to things. -Leonardo Da Vinci

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

GS

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives