The State of the Market

Stocks moved largely sideways last week in response to what appears to be conflicting narratives. But then again, given the overbought nature of the market and the overexuberant levels of sentiment, sideways beats the alternative.

This is not to say that the bears haven’t made an effort recently. No, the dueling negatives of Biden’s proposal for higher capital gains taxes and rising price pressures (don’t look now fans, but the cost of many commodities are surging) was enough to cause some selling. Now mix in the surge in COVID cases in places like India and Japan, and well, it is little wonder that some folks felt a pause in the joyride to the upside was warranted.

Yes, it is true that the proposal for higher capital gains taxes isn’t exactly news. And as several analysts pointed out late in the week, the chances of the administration getting everything they are proposing are basically slim and none. As such, the quick reversal in stock prices on Friday really wasn’t terribly surprising.

What is a bit surprising (well, to me anyway) is the idea that inflation might just rise faster and higher than any of Mr. Powell’s merry band of central bankers believe and that said inflation might just stick around a while. Therefore, I can’t blame some investors for thinking that taking some profits at all-time highs is a good idea.

Yet the positive side of the ledger still has two pretty powerful entries. Namely the booming economic data and the fact that analysts continue to fall all over themselves in an effort to raise earnings estimates for the year.

So, there you have it. On one hand you’ve got the lifeblood of bull markets (earnings and economic growth). And on the other you’ve got some very real concerns that could easily put a dent in those rosy expectations for the future.

The result over the past week or so has been a market that appears to be going nowhere fast as both teams appear to have an argument. You can call it a pause, a consolidation, or perhaps even the start of the next move (up or down!). But from my seat, it looks like sideways might be the new down – at least for now.

Here’s hoping you have a great week. Now let’s turn to our weekly model update…

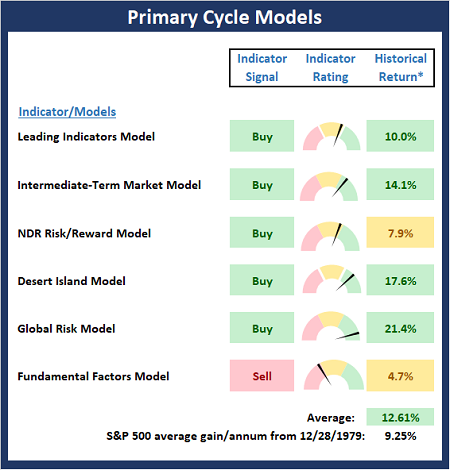

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

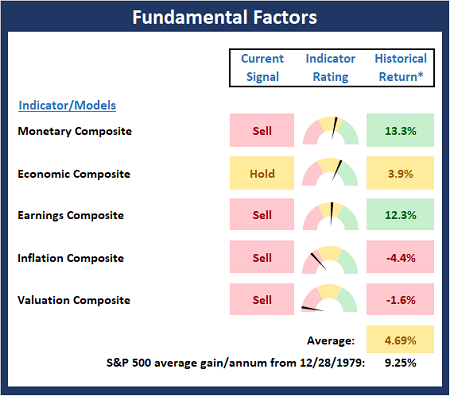

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

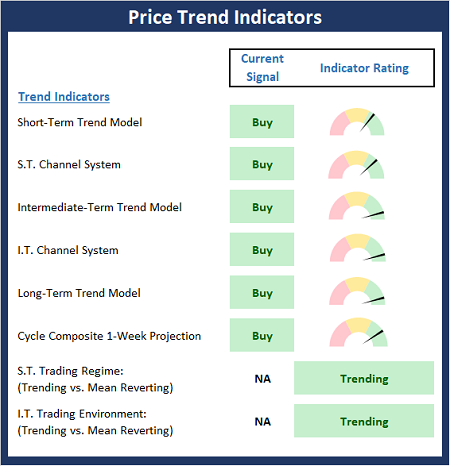

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

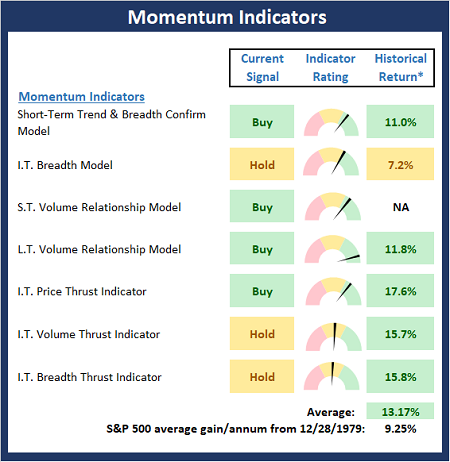

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

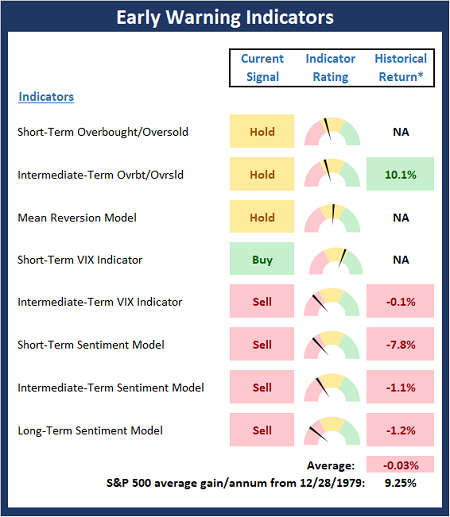

Early Warning Signals

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Market Models Explained

Thought for the Day:

Never follow the crowd. -Bernard Baruch

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Is Sideways The New Down?

The State of the Market

Stocks moved largely sideways last week in response to what appears to be conflicting narratives. But then again, given the overbought nature of the market and the overexuberant levels of sentiment, sideways beats the alternative.

This is not to say that the bears haven’t made an effort recently. No, the dueling negatives of Biden’s proposal for higher capital gains taxes and rising price pressures (don’t look now fans, but the cost of many commodities are surging) was enough to cause some selling. Now mix in the surge in COVID cases in places like India and Japan, and well, it is little wonder that some folks felt a pause in the joyride to the upside was warranted.

Yes, it is true that the proposal for higher capital gains taxes isn’t exactly news. And as several analysts pointed out late in the week, the chances of the administration getting everything they are proposing are basically slim and none. As such, the quick reversal in stock prices on Friday really wasn’t terribly surprising.

What is a bit surprising (well, to me anyway) is the idea that inflation might just rise faster and higher than any of Mr. Powell’s merry band of central bankers believe and that said inflation might just stick around a while. Therefore, I can’t blame some investors for thinking that taking some profits at all-time highs is a good idea.

Yet the positive side of the ledger still has two pretty powerful entries. Namely the booming economic data and the fact that analysts continue to fall all over themselves in an effort to raise earnings estimates for the year.

So, there you have it. On one hand you’ve got the lifeblood of bull markets (earnings and economic growth). And on the other you’ve got some very real concerns that could easily put a dent in those rosy expectations for the future.

The result over the past week or so has been a market that appears to be going nowhere fast as both teams appear to have an argument. You can call it a pause, a consolidation, or perhaps even the start of the next move (up or down!). But from my seat, it looks like sideways might be the new down – at least for now.

Here’s hoping you have a great week. Now let’s turn to our weekly model update…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Signals

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Market Models Explained

Thought for the Day:

Never follow the crowd. -Bernard Baruch

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives