There is an awful lot of talk about a recession these days. And while everyone is talking about the concept, the views on when and/or whether or not the good ‘ol USofA will fall into recession vary widely.

For example, on this fine summer Tuesday morning alone, Bloomberg reports that “Elon Musk, Nouriel Roubini and Goldman Sachs are all warning of the growing risk of a recession in the US, even though economists are estimating a less than one-in-three chance of an occurrence this year. Meanwhile, President Joe Biden has weighed in on the debate, saying that a contraction isn’t “inevitable” following a conversation with former Treasury Secretary Lawrence Summers.”

Clear as mud, right? In short, this appears to be an “on the one hand, yet on the other hand” situation as a great many folks continue to argue their case on the subject – in both directions.

How can this be, you ask? Isn’t it clear that the economy is slowing down? And since US GDP shrank by -1.5% in the first quarter, aren’t we already halfway to recession?

Therein lies the rub. If you were to ask 10 financial professionals for the definition of a recession, nine would likely answer with: Two consecutive quarters of negative GDP growth.

So, with one quarter of negative GDP already in the books and the Atlanta Fed’s GDPNow currently sitting at 0%, it is easy to see why many analysts are saying we are already in recession.

The problem is that 2 quarters of negative GDP growth is not the actual definition of a recession. According to the National Bureau of Economic Research (NBER), which is the official scorekeeper of such things, the definition of a recession is: A significant decline in economic activity that is spread across the economy and lasts more than a few months.

Put another way, a recession is a persistent, broad-based, deep decline in economic activity. To be sure, this is NOT what is happening now.

Sure, the economy is slowing. The evidence/data is everywhere. However, the current “slowdown” has more to do with the rate at which the economy was growing after the reopening. As we’ve discussed many times, the 6.9% growth rate seen in the 4th quarter of last year and 5.7% growth for all of calendar year 2021 was (a) artificially induced and (b) unsustainable.

Therefore, we’ve known for a long time now that the rate of economic growth would “slow down.” However, there is a massive difference between the rate of growth slowing from an unsustainably high rate and an actual economic slowdown. You know, where people stop taking trips, buying stuff, and essentially do less.

To be sure, the markets understand the situation. And from my seat, this is why stocks hadn’t been freaking out. Well, until recently, that is.

Up until a Russian dictator decided to invade his neighbor, things were “slowing” in a relatively calm fashion. But the supply of stuff (like wheat) and supply chain issues brought on by Putin’s reprehensible attack caused inflation to go into overdrive. And when coupled with the $10 trillion that had been dumped into consumers’ checking accounts and additional supply chain problems stemming from China’s Covid shutdown, the Fed was forced to take action.

And take action, they did. Last week, Jay Powell “went big” with the latest rate hike and suggested there is more of the same coming.

In essence, Mr. Powell and his merry band of central bankers are trying to whip inflation – now. And since they don’t have tools that could improve the supply of grains, oil, and other commodities, loosen supply chains, kill Covid, and/or convince Russia to stand down, the Fed will use the only tools it has available – rate hikes and selling bonds.

The classic definition of inflation is “too many dollars (which in this case, came from the Fed and Washington’s response to Covid) chasing too few goods (which is currently caused by supply chain issues and Russia’s war). So, Powell & Company are raising rates in order to reduce the demand for goods/services. In economic circles, this is called “demand destruction.”

The concept is simple enough, raise rates to a point where the excessive demand begins to tail off. You can think of this as the Fed applying the brakes to economic growth.

The trick is for the Fed to perform their inflation fighting tactics without hurting the economy too badly in the process. Professor Jeremy Siegel summed up the situation nicely last week by saying that while the Fed is slamming on the brakes, they must also try to avoid sending the economy through the windshield in the process.

THIS is what the markets have been fretting about lately. THIS is what sent the S&P 500 into “bear market territory.” And THIS is why oil stocks dove and yields backed up last week – fear of the economy going through the windshield and winding up in the ER.

Here’s hoping the seatbelts work.

So, analysts of all shapes, sizes, and colors are now busy prognosticating about the future. The bears tell us the sky is falling (again) and that the inflation problem will become a 1970’s redux. The bulls suggest everything will be fine and a tremendous buying opportunity is close at hand. In all likelihood, reality is somewhere in between.

In market vernacular, this is what “price discovery” is all about. Stocks need to “figure out” what the future looks like. So, when we get bad news, stocks go down – hard. When we get good news, they rise. And when the “argument” between the bulls and bears evens out, a bottom will form and a “basing phase” can begin.

Then, when the worst is thought to be behind us, the bulls will likely prevail – and the next bull market will be born. For those of you keeping score at home, it is important to remember that the average gain for bull market cycles since early 1900 has been more than 80%. And in my book, this is something to look forward to while markets try and work through the current macroeconomic outlook.

Now let’s review the “state of the market” through the lens of our market models…

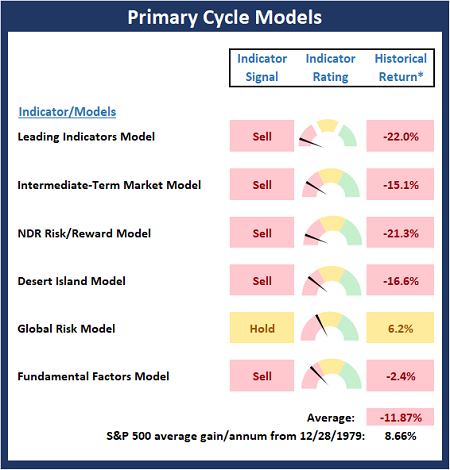

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

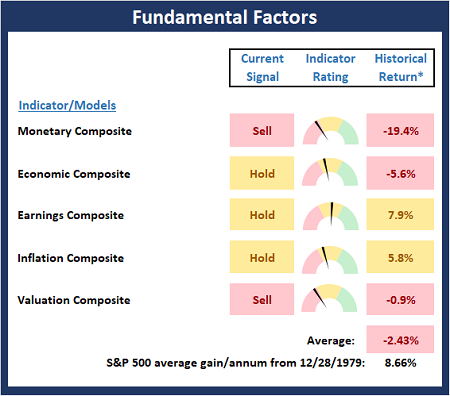

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

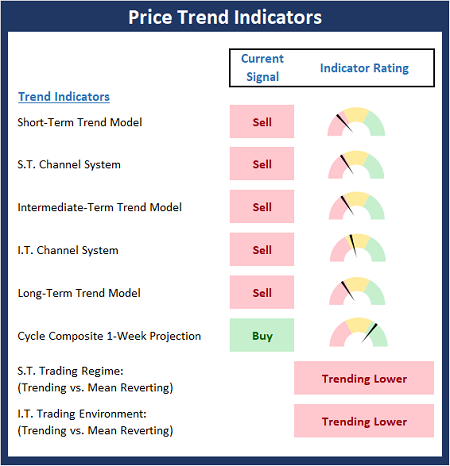

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

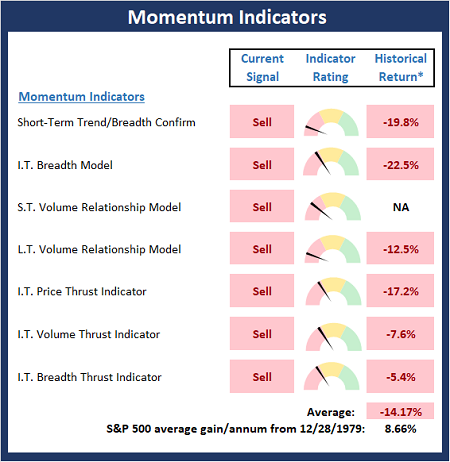

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

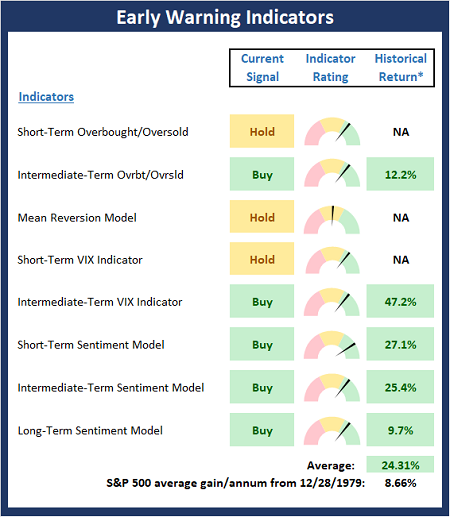

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

When the facts change, I change my mind. What do you do, sir? -John Maynard Keynes

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Hope the Seatbelts Work

There is an awful lot of talk about a recession these days. And while everyone is talking about the concept, the views on when and/or whether or not the good ‘ol USofA will fall into recession vary widely.

For example, on this fine summer Tuesday morning alone, Bloomberg reports that “Elon Musk, Nouriel Roubini and Goldman Sachs are all warning of the growing risk of a recession in the US, even though economists are estimating a less than one-in-three chance of an occurrence this year. Meanwhile, President Joe Biden has weighed in on the debate, saying that a contraction isn’t “inevitable” following a conversation with former Treasury Secretary Lawrence Summers.”

Clear as mud, right? In short, this appears to be an “on the one hand, yet on the other hand” situation as a great many folks continue to argue their case on the subject – in both directions.

How can this be, you ask? Isn’t it clear that the economy is slowing down? And since US GDP shrank by -1.5% in the first quarter, aren’t we already halfway to recession?

Therein lies the rub. If you were to ask 10 financial professionals for the definition of a recession, nine would likely answer with: Two consecutive quarters of negative GDP growth.

So, with one quarter of negative GDP already in the books and the Atlanta Fed’s GDPNow currently sitting at 0%, it is easy to see why many analysts are saying we are already in recession.

The problem is that 2 quarters of negative GDP growth is not the actual definition of a recession. According to the National Bureau of Economic Research (NBER), which is the official scorekeeper of such things, the definition of a recession is: A significant decline in economic activity that is spread across the economy and lasts more than a few months.

Put another way, a recession is a persistent, broad-based, deep decline in economic activity. To be sure, this is NOT what is happening now.

Sure, the economy is slowing. The evidence/data is everywhere. However, the current “slowdown” has more to do with the rate at which the economy was growing after the reopening. As we’ve discussed many times, the 6.9% growth rate seen in the 4th quarter of last year and 5.7% growth for all of calendar year 2021 was (a) artificially induced and (b) unsustainable.

Therefore, we’ve known for a long time now that the rate of economic growth would “slow down.” However, there is a massive difference between the rate of growth slowing from an unsustainably high rate and an actual economic slowdown. You know, where people stop taking trips, buying stuff, and essentially do less.

To be sure, the markets understand the situation. And from my seat, this is why stocks hadn’t been freaking out. Well, until recently, that is.

Up until a Russian dictator decided to invade his neighbor, things were “slowing” in a relatively calm fashion. But the supply of stuff (like wheat) and supply chain issues brought on by Putin’s reprehensible attack caused inflation to go into overdrive. And when coupled with the $10 trillion that had been dumped into consumers’ checking accounts and additional supply chain problems stemming from China’s Covid shutdown, the Fed was forced to take action.

And take action, they did. Last week, Jay Powell “went big” with the latest rate hike and suggested there is more of the same coming.

In essence, Mr. Powell and his merry band of central bankers are trying to whip inflation – now. And since they don’t have tools that could improve the supply of grains, oil, and other commodities, loosen supply chains, kill Covid, and/or convince Russia to stand down, the Fed will use the only tools it has available – rate hikes and selling bonds.

The classic definition of inflation is “too many dollars (which in this case, came from the Fed and Washington’s response to Covid) chasing too few goods (which is currently caused by supply chain issues and Russia’s war). So, Powell & Company are raising rates in order to reduce the demand for goods/services. In economic circles, this is called “demand destruction.”

The concept is simple enough, raise rates to a point where the excessive demand begins to tail off. You can think of this as the Fed applying the brakes to economic growth.

The trick is for the Fed to perform their inflation fighting tactics without hurting the economy too badly in the process. Professor Jeremy Siegel summed up the situation nicely last week by saying that while the Fed is slamming on the brakes, they must also try to avoid sending the economy through the windshield in the process.

THIS is what the markets have been fretting about lately. THIS is what sent the S&P 500 into “bear market territory.” And THIS is why oil stocks dove and yields backed up last week – fear of the economy going through the windshield and winding up in the ER.

Here’s hoping the seatbelts work.

So, analysts of all shapes, sizes, and colors are now busy prognosticating about the future. The bears tell us the sky is falling (again) and that the inflation problem will become a 1970’s redux. The bulls suggest everything will be fine and a tremendous buying opportunity is close at hand. In all likelihood, reality is somewhere in between.

In market vernacular, this is what “price discovery” is all about. Stocks need to “figure out” what the future looks like. So, when we get bad news, stocks go down – hard. When we get good news, they rise. And when the “argument” between the bulls and bears evens out, a bottom will form and a “basing phase” can begin.

Then, when the worst is thought to be behind us, the bulls will likely prevail – and the next bull market will be born. For those of you keeping score at home, it is important to remember that the average gain for bull market cycles since early 1900 has been more than 80%. And in my book, this is something to look forward to while markets try and work through the current macroeconomic outlook.

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

When the facts change, I change my mind. What do you do, sir? -John Maynard Keynes

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives