So many issues. So little time. Worry, worry, worry! This pretty much sums up the bear case in the stock market these days. Whether it be inflation, the Fed, Putin’s heinous attack on Ukraine, shortages, supply chain issues, earnings, or economic growth, there seems to be no shortage of things for investors to fret about. And for many, this is enough reason to view the market as a glass half-empty.

Yet on the other side of the court, our heroes in horns have largely refused to give up the ghost. Sure, the speculative growth and high valuation areas have been smoked, and even beloved names such as Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) have pulled back a bit this year. But don’t look fans, the S&P 500 (using SPY as a proxy) is off less than 8% on the year.

Garden Variety (So far)

Although the high valuation and “spectech” names have clearly experienced bear-market type declines due to rising rates and the implementation of discounted cash-flow concepts, the venerable blue-chip index remains in what is probably best described as a garden-variety correction.

If memory serves, stocks have, on average, experienced such a pullback about once a year or so. As such, my current take is the overall market performance isn’t too shabby given all the headline-induced handwringing that’s taken place so far in 2022.

While I tend to lean toward the optimistic side of things in the stock market, the chart below argues that the S&P is currently stuck in a sideways, rangebound mode.

S&P 500 – Daily

View Larger Chart

So Many Questions

My take is the market is in the process of trying to figure things out. As in how high rates are going to go. Or how long sky-high inflation is going to stick around. Or how long Putin’s reign of terror will last and/or how far the Russian dictator is going to go. Or how far the Fed is planning to go. Or what the impact of all of the above will be on growth – and earnings.

As I’ve said a time or twenty over the years, the market can “deal” with just about anything given enough time and the data necessary to create a likely scenario.

But at this stage of the game, the outcome of the many issues at hand are not certain. Not even close.

Inflation

For example, on the inflation front, there can be little argument that some inflation components will indeed be transitory. Within the CPI formula, there are things like used car/truck prices, which fell for the second consecutive month in March. And shelter costs (rent and owner’s equivalent rent), which appear to be decelerating at the moment.

Yet at the same time, fuel costs are soaring. As are food prices, which according to the UN’s Price Index, rose 13% in March (the fastest pace on record) and are up 50% since mid-2020. Yikes.

The surges seen in both energy and food prices can be directly attributed to Putin’s unprovoked and ruthless attack on Ukraine. In short, the horrific war has reduced the supply of energy and crops as Ukraine is one of the world’s leading growers of wheat.

The Fed

Then there is the Fed. I made the point last week that Jay Powell’s merry band of bankers has not, to date, declared war on inflation, Volcker-style. So far, the talk out of the Fed has been about “removing extraordinary stimulative measures” and “returning to normal.” And the majority of this discussion has centered on the pace and the extent of the quest to get Fed Funds back to “normal.”

Neutral Won’t Cut It

Yet with inflation soaring, the concern is that “neutral” isn’t likely to get the job done. Thus, if inflation remains obnoxiously high, then it follows Powell & Co. will have to get more aggressive. Last week, St. Louis Fed President Jim Bullard appeared to begin moving in this direction, saying that the central bank will have to be more aggressive in combating inflation by pushing rates above neutral.

And then Richmond Fed President Thomas Barkin said Wednesday that the US economy may be shifting to a “higher inflation regime,” a dynamic that could lead to more aggressive tightening cycles than in the past.

Many analysts believe, yours truly included, that both the stock and bond market have largely priced in the Fed’s current plan. But the key here is that the Fed “may” soon pivot once again – to a much more aggressive stance. Something that is likely NOT priced in at this stage. As such, another Fed pivot would likely create some additional “downside exploration” in the stock market.

Ultimately All About Growth

Then there is the growth/earnings picture. So far at least, the economy is “doing just fine, thank you.” But the fear is that the tide could soon turn.

For example, the NFIB Small Business Index fell again in March – its third consecutive decline. On an annual basis, the index is down 5.1%. Small Business owners are clearly concerned about inflation as 72% raised selling prices last month. Oh, and the percentage of small businesses who expect business to be better six months from now fell to a record low. Ugh.

In the last couple weeks, we’ve also gotten anecdotal evidence from the likes of JPM’s Jamie Dimon and US Treasury Secretary (and former Fed Chair) Janet Yellen on the state of the economy. Cutting to the chase, both issued warnings about the economy’s future.

On the Bright Side

On the positive side of the ledger was the earnings report from Delta Airlines (DAL) last week. The company said it is seeing big travel demand, which sparked a rally in all things reopening oriented.

On that note, recall that our stance has been that “economic normalization” will win out over the Fed’s moves. So, the news out of Delta – especially when coupled with March’s jobs report – was certainly welcome.

I could go on (and on), but I think you get the point. There are a lot of issues for the markets to deal with right now. Our take is that there is a tug-of-war playing out in the major indices, which could certainly last awhile.

Or put another way, we think stocks are going to spend a fair amount of time here trying to figure things out.

Now let’s review the “state of the market” through the lens of our market models…

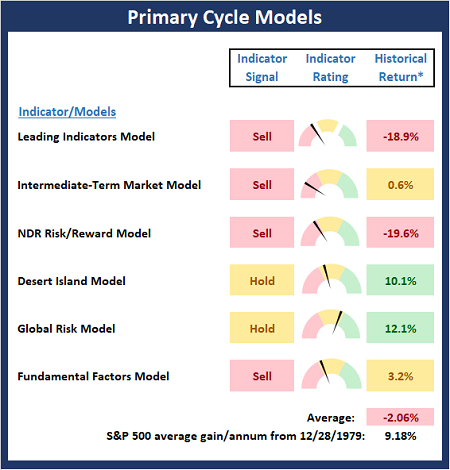

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

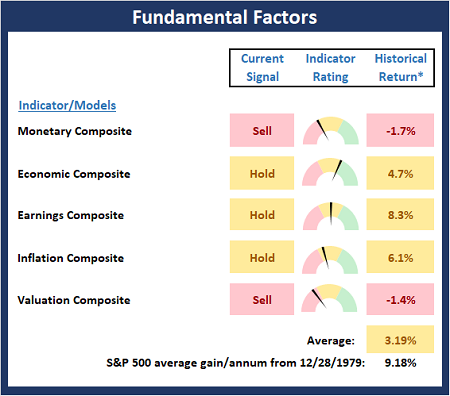

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

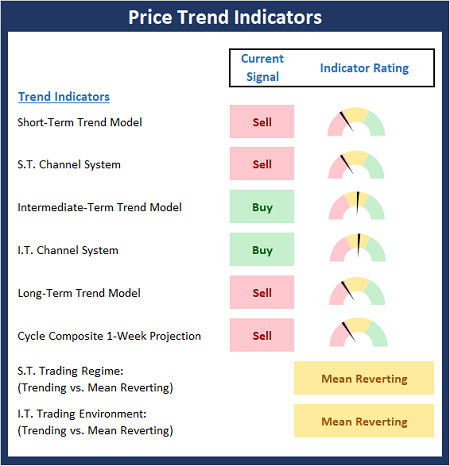

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

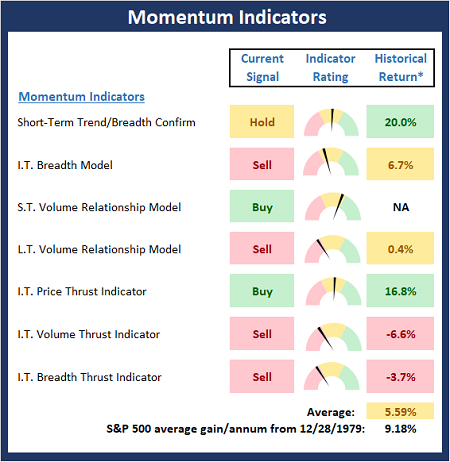

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

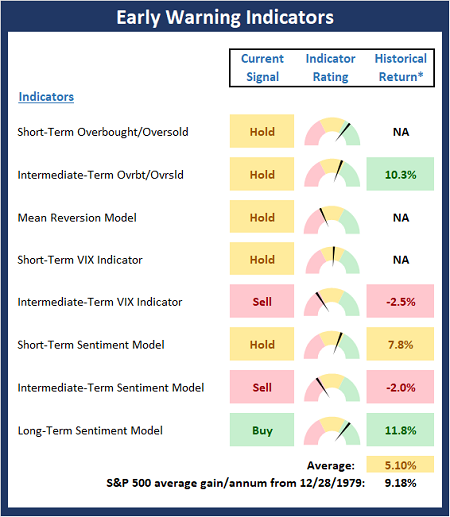

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

I hear and I forget. I see and I remember. I do and I understand. -Confucius

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

AAPL, NVDA, MSFT, GOOGL, SPY

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Figuring It Out

So many issues. So little time. Worry, worry, worry! This pretty much sums up the bear case in the stock market these days. Whether it be inflation, the Fed, Putin’s heinous attack on Ukraine, shortages, supply chain issues, earnings, or economic growth, there seems to be no shortage of things for investors to fret about. And for many, this is enough reason to view the market as a glass half-empty.

Yet on the other side of the court, our heroes in horns have largely refused to give up the ghost. Sure, the speculative growth and high valuation areas have been smoked, and even beloved names such as Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) have pulled back a bit this year. But don’t look fans, the S&P 500 (using SPY as a proxy) is off less than 8% on the year.

Garden Variety (So far)

Although the high valuation and “spectech” names have clearly experienced bear-market type declines due to rising rates and the implementation of discounted cash-flow concepts, the venerable blue-chip index remains in what is probably best described as a garden-variety correction.

If memory serves, stocks have, on average, experienced such a pullback about once a year or so. As such, my current take is the overall market performance isn’t too shabby given all the headline-induced handwringing that’s taken place so far in 2022.

While I tend to lean toward the optimistic side of things in the stock market, the chart below argues that the S&P is currently stuck in a sideways, rangebound mode.

S&P 500 – Daily

View Larger Chart

So Many Questions

My take is the market is in the process of trying to figure things out. As in how high rates are going to go. Or how long sky-high inflation is going to stick around. Or how long Putin’s reign of terror will last and/or how far the Russian dictator is going to go. Or how far the Fed is planning to go. Or what the impact of all of the above will be on growth – and earnings.

As I’ve said a time or twenty over the years, the market can “deal” with just about anything given enough time and the data necessary to create a likely scenario.

But at this stage of the game, the outcome of the many issues at hand are not certain. Not even close.

Inflation

For example, on the inflation front, there can be little argument that some inflation components will indeed be transitory. Within the CPI formula, there are things like used car/truck prices, which fell for the second consecutive month in March. And shelter costs (rent and owner’s equivalent rent), which appear to be decelerating at the moment.

Yet at the same time, fuel costs are soaring. As are food prices, which according to the UN’s Price Index, rose 13% in March (the fastest pace on record) and are up 50% since mid-2020. Yikes.

The surges seen in both energy and food prices can be directly attributed to Putin’s unprovoked and ruthless attack on Ukraine. In short, the horrific war has reduced the supply of energy and crops as Ukraine is one of the world’s leading growers of wheat.

The Fed

Then there is the Fed. I made the point last week that Jay Powell’s merry band of bankers has not, to date, declared war on inflation, Volcker-style. So far, the talk out of the Fed has been about “removing extraordinary stimulative measures” and “returning to normal.” And the majority of this discussion has centered on the pace and the extent of the quest to get Fed Funds back to “normal.”

Neutral Won’t Cut It

Yet with inflation soaring, the concern is that “neutral” isn’t likely to get the job done. Thus, if inflation remains obnoxiously high, then it follows Powell & Co. will have to get more aggressive. Last week, St. Louis Fed President Jim Bullard appeared to begin moving in this direction, saying that the central bank will have to be more aggressive in combating inflation by pushing rates above neutral.

And then Richmond Fed President Thomas Barkin said Wednesday that the US economy may be shifting to a “higher inflation regime,” a dynamic that could lead to more aggressive tightening cycles than in the past.

Many analysts believe, yours truly included, that both the stock and bond market have largely priced in the Fed’s current plan. But the key here is that the Fed “may” soon pivot once again – to a much more aggressive stance. Something that is likely NOT priced in at this stage. As such, another Fed pivot would likely create some additional “downside exploration” in the stock market.

Ultimately All About Growth

Then there is the growth/earnings picture. So far at least, the economy is “doing just fine, thank you.” But the fear is that the tide could soon turn.

For example, the NFIB Small Business Index fell again in March – its third consecutive decline. On an annual basis, the index is down 5.1%. Small Business owners are clearly concerned about inflation as 72% raised selling prices last month. Oh, and the percentage of small businesses who expect business to be better six months from now fell to a record low. Ugh.

In the last couple weeks, we’ve also gotten anecdotal evidence from the likes of JPM’s Jamie Dimon and US Treasury Secretary (and former Fed Chair) Janet Yellen on the state of the economy. Cutting to the chase, both issued warnings about the economy’s future.

On the Bright Side

On the positive side of the ledger was the earnings report from Delta Airlines (DAL) last week. The company said it is seeing big travel demand, which sparked a rally in all things reopening oriented.

On that note, recall that our stance has been that “economic normalization” will win out over the Fed’s moves. So, the news out of Delta – especially when coupled with March’s jobs report – was certainly welcome.

I could go on (and on), but I think you get the point. There are a lot of issues for the markets to deal with right now. Our take is that there is a tug-of-war playing out in the major indices, which could certainly last awhile.

Or put another way, we think stocks are going to spend a fair amount of time here trying to figure things out.

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

I hear and I forget. I see and I remember. I do and I understand. -Confucius

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

AAPL, NVDA, MSFT, GOOGL, SPY

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives