The late, great Marty Zweig, who had a huge influence on my career at a young age, was famous for his approach to managing risk in the stock market. As longtime readers are likely aware, one of his primary rules was, “Don’t fight the Fed.” Zweig, who along with Ned Davis (another constant influence on my approach to managing money) found creative ways to model such things via computers, which was a pretty novel approach back in the 1980’s and early 1990’s. Oh, and for the record, the Zweig Bond model is currently on a sell signal.

So, with Jay Powell’s Fed now set on battling inflation, one of the big-picture questions on my mind is, should we heed Marty’s advice here and take a cautious stance for a while?

An Addendum

Over the years, I have added my own twist on Marty’s famous market rule. As in, “Don’t fight the Fed – Especially when they are on a mission!” You see, times change, and the Fed has changed along with them. Back when Marty and Ned were creating their models, there was no such thing as QE (quantitative easing) or QT (quantitative tightening). No, the Fed’s only real tool back then was the Fed Funds rate. So, if the Fed was raising rates – such as they did in the early 1980’s – it was a bad thing for stocks. And vice versa; if the Fed was cutting rates, stocks tended to rise.

Game Changer

But then the Great Financial Crisis happened. And in short, Ben Bernanke’s Fed was forced to find more and very creative ways to try and keep the U.S. economy out of a Japanese-style deflationary spiral. Things like QE and a little something called ZIRP – Zero Interest Rate Policy (which has since been taken to extreme in other countries via NIRP – negative interest rate policy). The combination of which kept rates depressed for extended periods of time.

However, once the economy recovered, the Fed needed to remove their extraordinary stimulus schemes. This meant they had to raise rates. But unlike in times past, “Gentle Ben” wasn’t raising rates to slow the economy or fight inflation. No, rates were being increased to return them to some semblance of “normal.” I.E. The FOMC wasn’t really on a mission to slow anything down. Hence my addition to the “Don’t fight the Fed” rule.

Not On A Mission – Until They Were

Which brings us to the current situation where, up until a few weeks ago, the Fed wasn’t really on a mission. They were simply attempting to return rates and monetary policy back to more normal levels. As we’ve learned over the years, when rates stay artificially too low for too long, unintended consequences can happen. Many of which aren’t good.

As such, up until Jay Powell quite recently and very publicly declared war on inflation, I was of the mind that “Don’t fight the Fed” didn’t really apply here. But with the FOMC now united in a quest to hike rates and sell off nearly 100 billion a month in bonds – and doing so as fast as they can – my caveat to Mr. Zweig’s rule, “especially when they are on a mission,” would seem to apply.

Is It Different This Time?

But (you knew that was coming, right?) … As often seems to be the case in the markets these days, there is another wrinkle or two to consider here. First and foremost is the impact and the government’s response to the COVID pandemic. Cutting to the chase, the government dropped about $10 trillion of cash in consumer’s laps and the Fed pulled out all the stops – all in an effort to limit the impact of shuttering the economy to keep Americans safe.

Anyone who has taken Econ 101 likely knows that inflation is defined as, “too many dollars chasing too few goods.” And a great many economists believe that inflation is largely a monetary phenomenon. So, with the government dropping a bunch of cash into our checking accounts and COVID wreaking all kinds of havoc with companies’ ability to deliver goods, voila, inflation was born – in a big way.

For a while, the Fed argued that inflation was likely “transitory” due to the idea that COVID and the associated supply chain disruptions would fade over time. But neither COVID nor the supply chain problems went away. In fact, just about the time everybody thought we were making headway on both issues, Omicron hit. Bam, just like that, COVID was back, and supply chain problems not only didn’t improve, they got worse. As did the inflation rate.

The Wage Genie is Out of the Bottle

Along the way, employees figured out they suddenly had some power – as in, pricing power, so to speak. As the pandemic wore on and we figured out how COVID spread (well, in the beginning, anyway), nobody wanted to work at fast food joints, or restaurants, or grocery stores, etc. In response, and out of a desperate need for staff, wages started to rise. Hiring bonuses were paid. And so on.

This concept also spread to white collar America as employees figured out WFH (work from home) meant their opportunities for better – and higher paying – jobs were rising. All of a sudden, workers could consider jobs that didn’t require them to live in excruciatingly high rent areas. Or for them to live in a particular climate. Or be close to the office, etc. Just like that, the wages genie was out of the bottle – in a meaningful way. And my guess is that this is something that isn’t going to change any time soon.

The Fed’s Goal

So, how exactly is the Fed supposed to stop “wage inflation” or help companies get more stuff to sell? The answer is simple – they need the economy to slow the heck down. Hence the Fed’s sudden sense of urgency in trying to get rates back up to more normal levels. And in theory, this is why Marty Zweig’s “Don’t fight the Fed” rule (as well as my addendum) would seem to be in play.

But here’s the thing. Don’t look now fans, but COVID appears to be fading. Yes, there is the potential for the Ba.2 variant to create another wave. However, with vaccines, boosters, and the astounding number of folks infected with Omicron, experts such as Dr. Scott Gottlieb tell us that the pandemic will soon fade.

Economic Normalization

This means the current trend of returning to normal can continue. And my guess is there is still incredible pent-up demand for all kinds of stuff. Such as stuff we couldn’t get or stuff we weren’t allowed to do.

Now consider that from the reports I’ve seen, both the consumer and corporate America are in great shape from a balance sheet standpoint. As such, the thinking is that economic growth isn’t going to slow in any meaningful way in the near term. No matter if the Fed raises rates 6 or 7 times this year.

Higher, Not High

Another way to think about this is the economy may not slow down much given the Fed’s current plans. My take is even with the bunch of rate hikes on the table, interest rates will be “higher but not “high” from an historical perspective. So, while rates may go higher, they may not be high enough to bite.

The bears will be quick to counter with the idea that the Fed will be forced to keep going. To keep hiking. To keep selling bonds. Until they get what they want.

This could certainly happen. And if Jay Powell starts saying that the Fed will keep hiking/selling until inflation gets back down to their target, this could certainly be a problem for stocks.

But the Fed likes to be transparent. And for now, the Fed’s plan is to return rates to “normal” (which of course is a moving target). But at this stage, the Fed’s “normal” appears to be somewhere between 2.5% and 3.0%. Again, from my seat this represents a “higher, not high” situation.

Does Normalization Trump the Fed?

So, until/unless the Powell & Co. decide to go all-in, Volcker-style, my bet is that “economic normalization” will trump the Fed. This means the economy won’t stall. Earnings won’t tank. And if this turns out to be the case, a buy-the-dips approach to the stock market makes sense to me.

However, should Powell decide this is his Volcker moment and if economic growth and/or earnings do start to stall out or decline, this is a horse of a completely different color. In short, this scenario would require a healthy dose of risk management.

My Plan

For me, the current plan is to continue to watch both the economy and earnings. My thinking is that as these go, so goes the stock market. Yet at the same time, the real key to this type of market environment is to stay flexible and keep an open mind. After all, we’ve never seen this type of situation before. So, nobody really knows how this thing will turn out.

Now let’s review the “state of the market” through the lens of our market models…

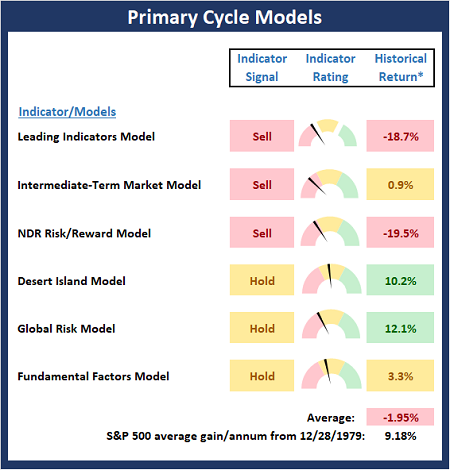

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

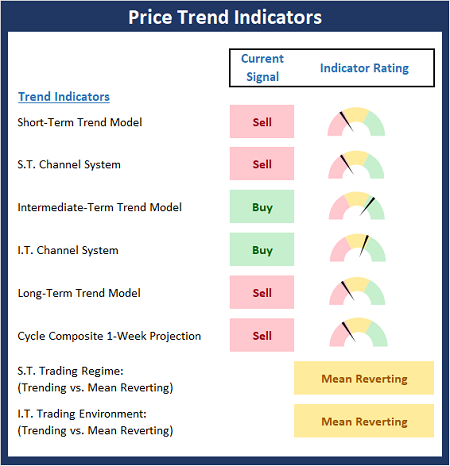

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

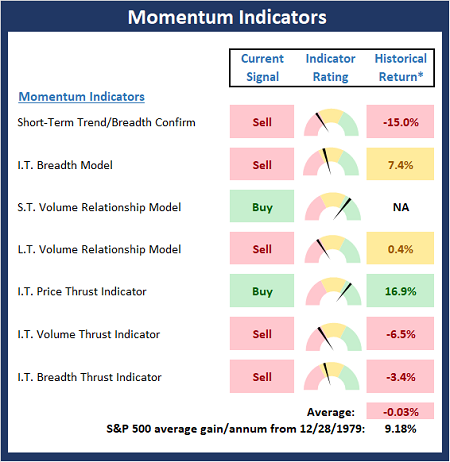

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

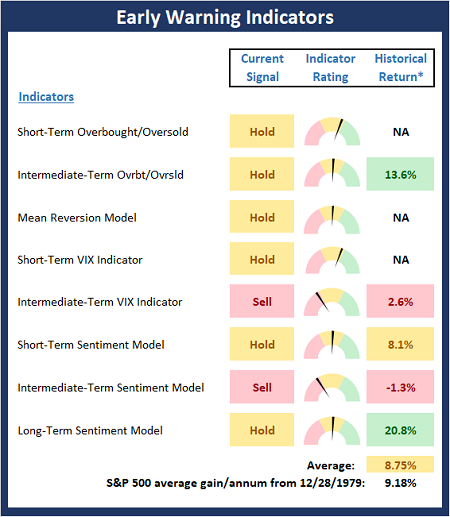

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

The only disability in life is a bad attitude. -Scott Hamilton

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Don’t Fight The Fed?

The late, great Marty Zweig, who had a huge influence on my career at a young age, was famous for his approach to managing risk in the stock market. As longtime readers are likely aware, one of his primary rules was, “Don’t fight the Fed.” Zweig, who along with Ned Davis (another constant influence on my approach to managing money) found creative ways to model such things via computers, which was a pretty novel approach back in the 1980’s and early 1990’s. Oh, and for the record, the Zweig Bond model is currently on a sell signal.

So, with Jay Powell’s Fed now set on battling inflation, one of the big-picture questions on my mind is, should we heed Marty’s advice here and take a cautious stance for a while?

An Addendum

Over the years, I have added my own twist on Marty’s famous market rule. As in, “Don’t fight the Fed – Especially when they are on a mission!” You see, times change, and the Fed has changed along with them. Back when Marty and Ned were creating their models, there was no such thing as QE (quantitative easing) or QT (quantitative tightening). No, the Fed’s only real tool back then was the Fed Funds rate. So, if the Fed was raising rates – such as they did in the early 1980’s – it was a bad thing for stocks. And vice versa; if the Fed was cutting rates, stocks tended to rise.

Game Changer

But then the Great Financial Crisis happened. And in short, Ben Bernanke’s Fed was forced to find more and very creative ways to try and keep the U.S. economy out of a Japanese-style deflationary spiral. Things like QE and a little something called ZIRP – Zero Interest Rate Policy (which has since been taken to extreme in other countries via NIRP – negative interest rate policy). The combination of which kept rates depressed for extended periods of time.

However, once the economy recovered, the Fed needed to remove their extraordinary stimulus schemes. This meant they had to raise rates. But unlike in times past, “Gentle Ben” wasn’t raising rates to slow the economy or fight inflation. No, rates were being increased to return them to some semblance of “normal.” I.E. The FOMC wasn’t really on a mission to slow anything down. Hence my addition to the “Don’t fight the Fed” rule.

Not On A Mission – Until They Were

Which brings us to the current situation where, up until a few weeks ago, the Fed wasn’t really on a mission. They were simply attempting to return rates and monetary policy back to more normal levels. As we’ve learned over the years, when rates stay artificially too low for too long, unintended consequences can happen. Many of which aren’t good.

As such, up until Jay Powell quite recently and very publicly declared war on inflation, I was of the mind that “Don’t fight the Fed” didn’t really apply here. But with the FOMC now united in a quest to hike rates and sell off nearly 100 billion a month in bonds – and doing so as fast as they can – my caveat to Mr. Zweig’s rule, “especially when they are on a mission,” would seem to apply.

Is It Different This Time?

But (you knew that was coming, right?) … As often seems to be the case in the markets these days, there is another wrinkle or two to consider here. First and foremost is the impact and the government’s response to the COVID pandemic. Cutting to the chase, the government dropped about $10 trillion of cash in consumer’s laps and the Fed pulled out all the stops – all in an effort to limit the impact of shuttering the economy to keep Americans safe.

Anyone who has taken Econ 101 likely knows that inflation is defined as, “too many dollars chasing too few goods.” And a great many economists believe that inflation is largely a monetary phenomenon. So, with the government dropping a bunch of cash into our checking accounts and COVID wreaking all kinds of havoc with companies’ ability to deliver goods, voila, inflation was born – in a big way.

For a while, the Fed argued that inflation was likely “transitory” due to the idea that COVID and the associated supply chain disruptions would fade over time. But neither COVID nor the supply chain problems went away. In fact, just about the time everybody thought we were making headway on both issues, Omicron hit. Bam, just like that, COVID was back, and supply chain problems not only didn’t improve, they got worse. As did the inflation rate.

The Wage Genie is Out of the Bottle

Along the way, employees figured out they suddenly had some power – as in, pricing power, so to speak. As the pandemic wore on and we figured out how COVID spread (well, in the beginning, anyway), nobody wanted to work at fast food joints, or restaurants, or grocery stores, etc. In response, and out of a desperate need for staff, wages started to rise. Hiring bonuses were paid. And so on.

This concept also spread to white collar America as employees figured out WFH (work from home) meant their opportunities for better – and higher paying – jobs were rising. All of a sudden, workers could consider jobs that didn’t require them to live in excruciatingly high rent areas. Or for them to live in a particular climate. Or be close to the office, etc. Just like that, the wages genie was out of the bottle – in a meaningful way. And my guess is that this is something that isn’t going to change any time soon.

The Fed’s Goal

So, how exactly is the Fed supposed to stop “wage inflation” or help companies get more stuff to sell? The answer is simple – they need the economy to slow the heck down. Hence the Fed’s sudden sense of urgency in trying to get rates back up to more normal levels. And in theory, this is why Marty Zweig’s “Don’t fight the Fed” rule (as well as my addendum) would seem to be in play.

But here’s the thing. Don’t look now fans, but COVID appears to be fading. Yes, there is the potential for the Ba.2 variant to create another wave. However, with vaccines, boosters, and the astounding number of folks infected with Omicron, experts such as Dr. Scott Gottlieb tell us that the pandemic will soon fade.

Economic Normalization

This means the current trend of returning to normal can continue. And my guess is there is still incredible pent-up demand for all kinds of stuff. Such as stuff we couldn’t get or stuff we weren’t allowed to do.

Now consider that from the reports I’ve seen, both the consumer and corporate America are in great shape from a balance sheet standpoint. As such, the thinking is that economic growth isn’t going to slow in any meaningful way in the near term. No matter if the Fed raises rates 6 or 7 times this year.

Higher, Not High

Another way to think about this is the economy may not slow down much given the Fed’s current plans. My take is even with the bunch of rate hikes on the table, interest rates will be “higher but not “high” from an historical perspective. So, while rates may go higher, they may not be high enough to bite.

The bears will be quick to counter with the idea that the Fed will be forced to keep going. To keep hiking. To keep selling bonds. Until they get what they want.

This could certainly happen. And if Jay Powell starts saying that the Fed will keep hiking/selling until inflation gets back down to their target, this could certainly be a problem for stocks.

But the Fed likes to be transparent. And for now, the Fed’s plan is to return rates to “normal” (which of course is a moving target). But at this stage, the Fed’s “normal” appears to be somewhere between 2.5% and 3.0%. Again, from my seat this represents a “higher, not high” situation.

Does Normalization Trump the Fed?

So, until/unless the Powell & Co. decide to go all-in, Volcker-style, my bet is that “economic normalization” will trump the Fed. This means the economy won’t stall. Earnings won’t tank. And if this turns out to be the case, a buy-the-dips approach to the stock market makes sense to me.

However, should Powell decide this is his Volcker moment and if economic growth and/or earnings do start to stall out or decline, this is a horse of a completely different color. In short, this scenario would require a healthy dose of risk management.

My Plan

For me, the current plan is to continue to watch both the economy and earnings. My thinking is that as these go, so goes the stock market. Yet at the same time, the real key to this type of market environment is to stay flexible and keep an open mind. After all, we’ve never seen this type of situation before. So, nobody really knows how this thing will turn out.

Now let’s review the “state of the market” through the lens of our market models…

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

The only disability in life is a bad attitude. -Scott Hamilton

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives