Here we go again. Just when you thought positive economic news was a good thing – because strong data support the soft landing (or better) narrative – traders turned the game on its head. Again.

Stocks experienced their worst day of the year yesterday on the back of news that S&P Global’s Flash Services PMI came in better than expected. In fact, the read on the services sector of the economy came in at 50.5, which was (a) well above the consensus expectations for 47.1, (b) significantly higher than January’s 46.8, (c) back in the “expansion” zone, and (d) the highest reading in 8 months. All good, right?

The better-than-expected Flash Services PMI corroborated last week’s Philly Fed Services Index, which also surprised to the upside and broke back into the positive side of the ledger.

This, when coupled with January’s blowout Jobs report, which included stunning job creation numbers and a decline in the unemployment rate, as well as the recent wages data prompted St Louis Fed President James Bullard (a noted inflation hawk and market mover) to admit this morning that the economy was “stronger than we thought.”

Bullard went on to say that he believes, “we have a good shot at beating inflation in 2023.” And here’s the best part, wait for it… without a recession.

To any logical person, this all appears to be good news. This is the stuff of soft landings. Of recession avoidance. Or, perhaps even, a “no landing” in which economic growth continues to be strong but inflation remains sticky.

Thinking logically again, good economic data supports corporate earnings. And with the odds of recession now appearing to be falling as opposed to rising, investors ought to be looking ahead to better days.

Yes, yes, I know. The January rally in stocks was said to be representative of just that – I.E. the discounting of a stronger economy and falling inflation.

And yes, I understand the bear argument that the nice pop in stock prices to start the year was also accompanied by a significant “disconnect” with bond yields – as stocks and yields were both rising in January.

Although many analysts have expressed confusion about this, my thinking/explanation is pretty straightforward. Stocks and bonds were both “discounting” the improved economic conditions. And then when you toss in the recent hotter than expected inflation data, bond traders were forced to make some additional adjustments.

But I ask you, does this “reset” in thinking, which includes another couple (or three) rate hikes, really change anything in the macro backdrop? The Fed has been clear, they will be data dependent. So, if inflation comes down over time, as is the expectation, then what are the stock bears so worried about?

So, here’s where I am on the fine Wednesday morning. I see a stock market that was overbought and a rally that may have gotten ahead of itself. Couple this with the hot CPI/PPI numbers and a pullback was certainly to be expected. Everybody knows this. So, after a big move, buyers likely decided to cool it for a bit. Stand aside. Sit on their hands. Which, of course, leaves a vacuum for the bears to exploit.

Then when technical support gives way during the barrage of selling and there are some widely followed moving averages just below (the 50- and 200-day for example) a “whoosh” lower can occur to “test” those important levels. Check.

So, from my seat, the test is “on.” The test of support. Of the moving averages. And of the bulls resolve. Should investors be looking ahead to better days when the Fed will step aside? Or as the Morgan Stanley’s Mike Wilson contends, to the doom and gloom that is sure to follow?

THIS is where things get interesting. THIS is where investors must pick a side and/or take a stand. And THIS is likely where possession of the ball gets determined. As in, is this the start of a new cyclical bull market? Or just another in a string of bear market rallies? We shall see.

But for now, I’m in the cautiously optimistic camp. Yet at the same time, as a rules-guided investor, if my models start to wave red flags, I’ll certainly follow. But again, at this stage, I’m looking on the bright side.

Publishing Note: I am traveling early next week and will not publish a report.

Now let’s review the “state of the market” through the lens of our market models…

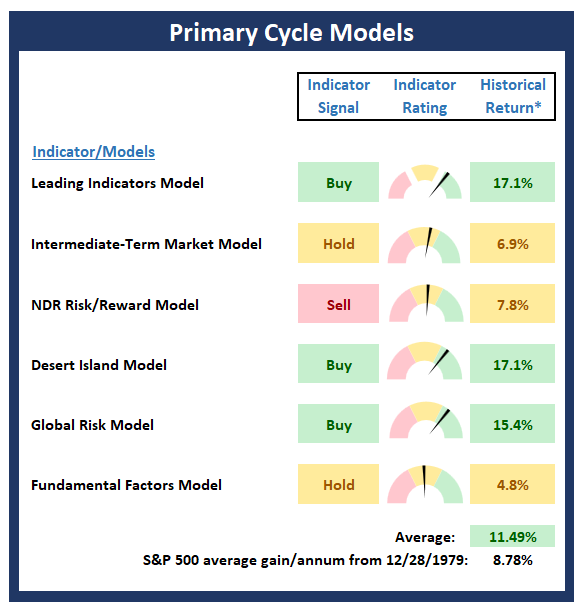

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

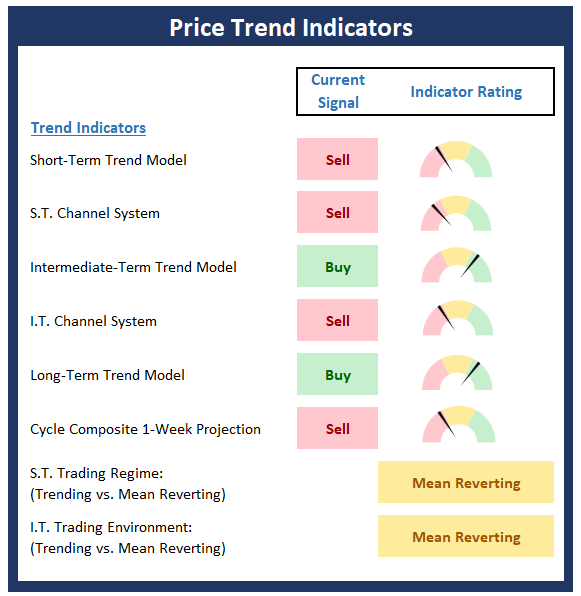

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

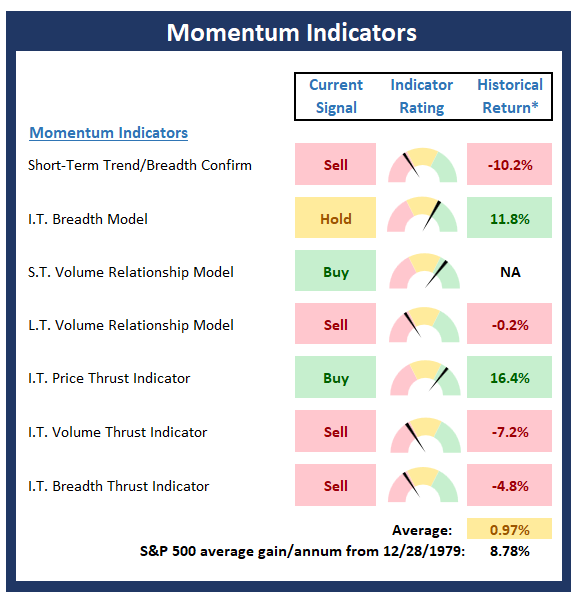

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

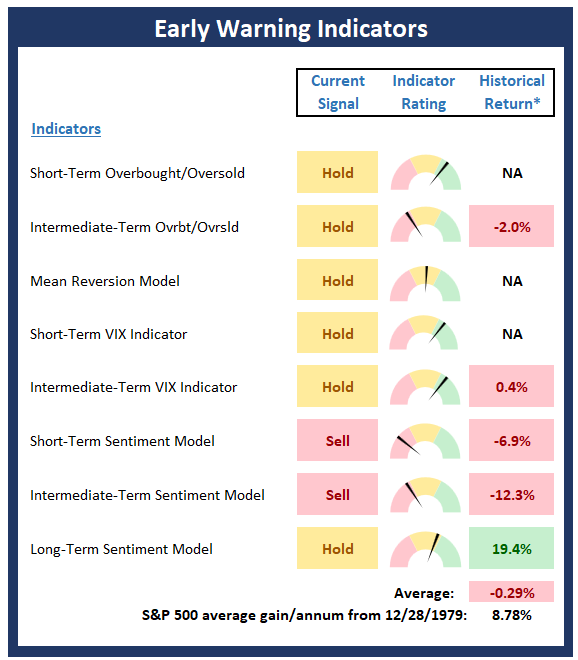

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

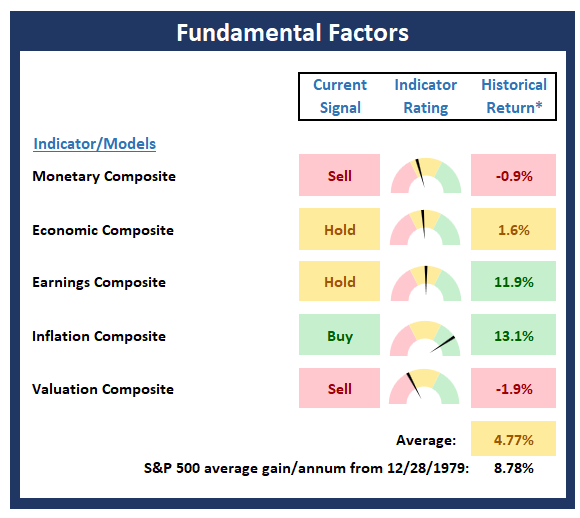

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Be as you wish to seem. -Socrates

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

Institutional Consulting

David Moenning

Color Me Cautiously Optimistic

Here we go again. Just when you thought positive economic news was a good thing – because strong data support the soft landing (or better) narrative – traders turned the game on its head. Again.

Stocks experienced their worst day of the year yesterday on the back of news that S&P Global’s Flash Services PMI came in better than expected. In fact, the read on the services sector of the economy came in at 50.5, which was (a) well above the consensus expectations for 47.1, (b) significantly higher than January’s 46.8, (c) back in the “expansion” zone, and (d) the highest reading in 8 months. All good, right?

The better-than-expected Flash Services PMI corroborated last week’s Philly Fed Services Index, which also surprised to the upside and broke back into the positive side of the ledger.

This, when coupled with January’s blowout Jobs report, which included stunning job creation numbers and a decline in the unemployment rate, as well as the recent wages data prompted St Louis Fed President James Bullard (a noted inflation hawk and market mover) to admit this morning that the economy was “stronger than we thought.”

Bullard went on to say that he believes, “we have a good shot at beating inflation in 2023.” And here’s the best part, wait for it… without a recession.

To any logical person, this all appears to be good news. This is the stuff of soft landings. Of recession avoidance. Or, perhaps even, a “no landing” in which economic growth continues to be strong but inflation remains sticky.

Thinking logically again, good economic data supports corporate earnings. And with the odds of recession now appearing to be falling as opposed to rising, investors ought to be looking ahead to better days.

Yes, yes, I know. The January rally in stocks was said to be representative of just that – I.E. the discounting of a stronger economy and falling inflation.

And yes, I understand the bear argument that the nice pop in stock prices to start the year was also accompanied by a significant “disconnect” with bond yields – as stocks and yields were both rising in January.

Although many analysts have expressed confusion about this, my thinking/explanation is pretty straightforward. Stocks and bonds were both “discounting” the improved economic conditions. And then when you toss in the recent hotter than expected inflation data, bond traders were forced to make some additional adjustments.

But I ask you, does this “reset” in thinking, which includes another couple (or three) rate hikes, really change anything in the macro backdrop? The Fed has been clear, they will be data dependent. So, if inflation comes down over time, as is the expectation, then what are the stock bears so worried about?

So, here’s where I am on the fine Wednesday morning. I see a stock market that was overbought and a rally that may have gotten ahead of itself. Couple this with the hot CPI/PPI numbers and a pullback was certainly to be expected. Everybody knows this. So, after a big move, buyers likely decided to cool it for a bit. Stand aside. Sit on their hands. Which, of course, leaves a vacuum for the bears to exploit.

Then when technical support gives way during the barrage of selling and there are some widely followed moving averages just below (the 50- and 200-day for example) a “whoosh” lower can occur to “test” those important levels. Check.

So, from my seat, the test is “on.” The test of support. Of the moving averages. And of the bulls resolve. Should investors be looking ahead to better days when the Fed will step aside? Or as the Morgan Stanley’s Mike Wilson contends, to the doom and gloom that is sure to follow?

THIS is where things get interesting. THIS is where investors must pick a side and/or take a stand. And THIS is likely where possession of the ball gets determined. As in, is this the start of a new cyclical bull market? Or just another in a string of bear market rallies? We shall see.

But for now, I’m in the cautiously optimistic camp. Yet at the same time, as a rules-guided investor, if my models start to wave red flags, I’ll certainly follow. But again, at this stage, I’m looking on the bright side.

Publishing Note: I am traveling early next week and will not publish a report.

Now let’s review the “state of the market” through the lens of our market models…

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Be as you wish to seem. -Socrates

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives