Good morning and Happy Monday. It is safe to say that most investors are anxiously awaiting the arrival of the monthly update to the Consumer Price Index. Scheduled to be released tomorrow morning, the CPI will provide members of both teams a glimpse into the state of inflation.

Although the month-over-month headline number is expected to rise by about 0.5%, which represents a pretty hefty increase over December’s 0.1% monthly gain, the key to the report will be the year-over-year comparisons. The consensus expectations among analysts is for the annual gain in prices to fall from December’s 6.5% to 6.2%. In short, the thinking is this would indicate that inflation is continuing to trend in the right direction.

However, one of the biggest worries in the market here is that inflation will remain “sticky” due to all those jobs the economy keeps creating. Which, in turn, provides all but the low-end consumer with the ability to pay for the stuff they want regardless of whether it costs a little more or not.

The thinking is that if inflation doesn’t start to trend lower in the near term, the Fed, in its quest to remain “data dependent” will continue to hike rates – and wind up “overdoing it” in the process. And this, dear readers, puts the concept of a “hard landing” (i.e., a severe recession) in play.

Why is this important, you ask? It’s simple, really. If the economy can avoid a meaningful recession and the Fed can step aside, then stocks can look ahead to better days – via higher prices, of course. However, if the Fed is forced to keep raising rates, then it is a safe bet that earnings are going to be impacted over time. And not in a good way.

Those seeing the market’s glass as at least half empty contend that stocks would have to decline – perhaps a lot – to “price in” such a scenario. And this is what all those calls for the S&P to fall into the low 3,000’s is based on.

So, it will suffice to say that Tuesday’s CPI is the key to this week’s data releases and perhaps the near-term direction of both stock and bond prices. Stick around, this is likely to be interesting.

While We Wait…

While we wait, I thought it might be a good idea to take a look at the state of the market trends as there are some interesting developments to note on the charts.

From a shorter-term perspective, the good news is the venerable S&P 500 index is now in a confirmed uptrend. See the chart below.

S&P 500 Daily

View Full Size Chart

The key is the series of “higher highs” and “higher lows” (circled on the chart) seen since last October. Cutting to the chase, this is the very definition of an uptrend.

This is clearly good news as investors came into 2023 braced for the worst as sentiment was nothing short of dour with just about everybody on the planet expecting the Fed to make a mistake and for stock prices to “price in” a hard landing.

However, it is important to understand the any trend – up or down – tends to move in a stairstep fashion. Two steps forward and one step back, if you will. This too is illustrated on chart above.

So, we shouldn’t be too surprised if the market breaks down hard (on a hot CPI report, maybe?) in the near-term to “test” the uptrend line. As such, we might expect to see the S&P test the 3970 – 4000 in the next week or so. Also note that both the 50-day and 200-day moving averages currently resides in this area, marking a technically important zone to watch closely.

Should the bears prevail with lower prices, the next key line in the sand is the 3745 area, which is the previous low. As long as that low “holds,” then our heroes in horns will argue that the trend is still up and that they are in control the game.

But… If the bulls fail to hold this line in the sand on any downside assault, one can argue that the uptrend has now ended, and a test of the October low is “on.”

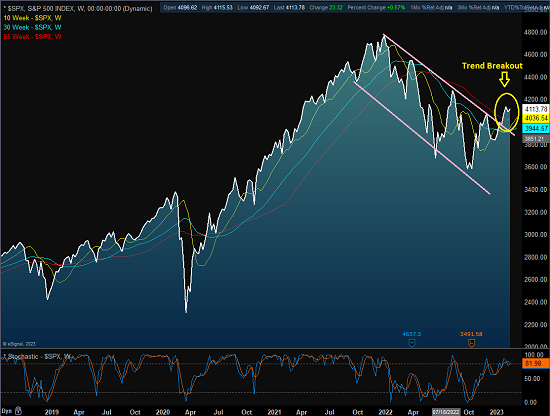

Next, let’s take a peek at the longer-term picture via a weekly chart.

S&P 500 Weekly

View Full Size Chart

As you can see, until just recently, the market had been entrenched in a downtrend. As we discussed above, the series of lower highs and lower lows provides the textbook definition of a downtrend.

However, there is some good news here as well as the downtrend has been “broken” by the bulls’ most recent joyride to the upside. Which is a good thing.

Although the bulls would like nothing better than to continue the current rally for a while, a pullback is to be expected. And as we highlighted on the daily chart, the key for the bulls is to keep those “higher highs and higher lows” coming. So, as long as the S&P can stay above 3830(ish), the uptrend will remain intact.

So, there you have it. From my seat, it is important to remember that market trends ebb and flow and that “countertrend moves” are to be expected.

The question is how one approaches these “go the other way” type moves. For example, if your longer-term view is positive, you may want to buy/add every time the market “dips.” Conversely, if you are currently sporting your bear cap, then you will want to sell the rallies and await “lower lows” ahead.

In my humble opinion, this is what the game is all about at this time. If inflation trends down – at the appropriate rate – the bulls are likely to retain possession of the ball. But if not, well, it’ll be time to watch those key lines in the sand.

Now let’s review the “state of the market” through the lens of our market models…

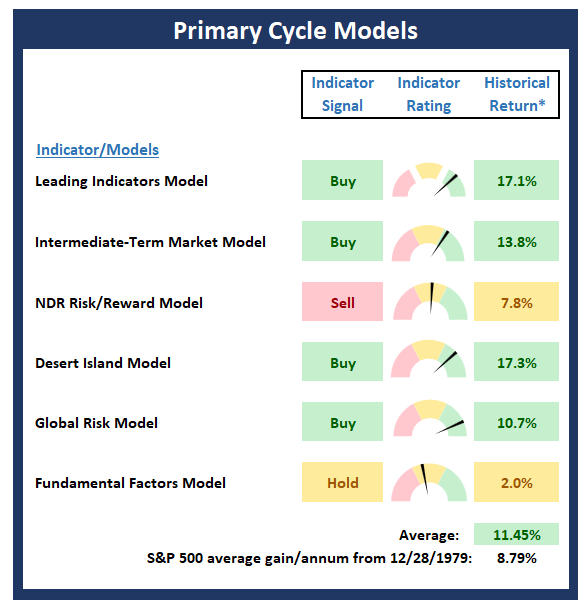

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

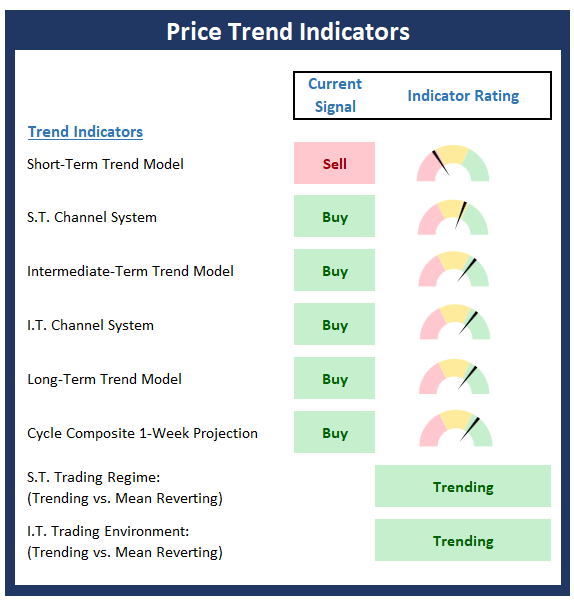

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Key Price Levels

- S&P 500 Near-Term Support Zone: 4020

- S&P 500 Near-Term Resistance Zone: 4195

- S&P 500 50-day Simple MA: 3969

- MA Direction: Rising

- S&P 500 200-day Simple MA: 3949

- MA Direction: Declining

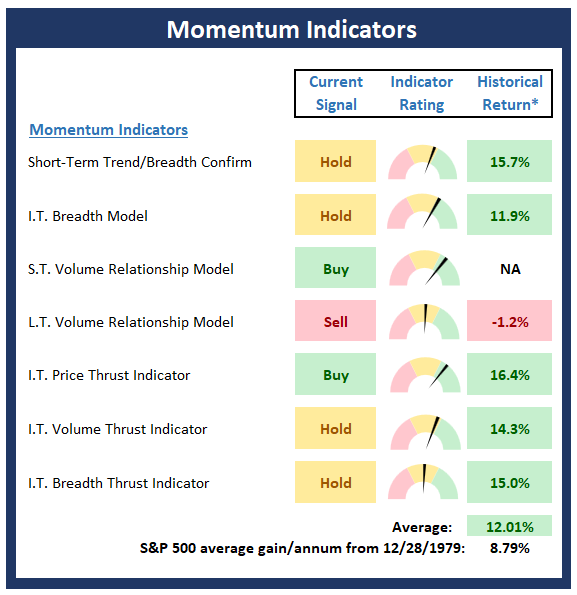

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Regardless of the color on the screens, try embracing an “attitude of gratitude” today…

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

Institutional Consulting

David Moenning

All About Inflation And the Lines in the Sand

Good morning and Happy Monday. It is safe to say that most investors are anxiously awaiting the arrival of the monthly update to the Consumer Price Index. Scheduled to be released tomorrow morning, the CPI will provide members of both teams a glimpse into the state of inflation.

Although the month-over-month headline number is expected to rise by about 0.5%, which represents a pretty hefty increase over December’s 0.1% monthly gain, the key to the report will be the year-over-year comparisons. The consensus expectations among analysts is for the annual gain in prices to fall from December’s 6.5% to 6.2%. In short, the thinking is this would indicate that inflation is continuing to trend in the right direction.

However, one of the biggest worries in the market here is that inflation will remain “sticky” due to all those jobs the economy keeps creating. Which, in turn, provides all but the low-end consumer with the ability to pay for the stuff they want regardless of whether it costs a little more or not.

The thinking is that if inflation doesn’t start to trend lower in the near term, the Fed, in its quest to remain “data dependent” will continue to hike rates – and wind up “overdoing it” in the process. And this, dear readers, puts the concept of a “hard landing” (i.e., a severe recession) in play.

Why is this important, you ask? It’s simple, really. If the economy can avoid a meaningful recession and the Fed can step aside, then stocks can look ahead to better days – via higher prices, of course. However, if the Fed is forced to keep raising rates, then it is a safe bet that earnings are going to be impacted over time. And not in a good way.

Those seeing the market’s glass as at least half empty contend that stocks would have to decline – perhaps a lot – to “price in” such a scenario. And this is what all those calls for the S&P to fall into the low 3,000’s is based on.

So, it will suffice to say that Tuesday’s CPI is the key to this week’s data releases and perhaps the near-term direction of both stock and bond prices. Stick around, this is likely to be interesting.

While We Wait…

While we wait, I thought it might be a good idea to take a look at the state of the market trends as there are some interesting developments to note on the charts.

From a shorter-term perspective, the good news is the venerable S&P 500 index is now in a confirmed uptrend. See the chart below.

S&P 500 Daily

View Full Size Chart

The key is the series of “higher highs” and “higher lows” (circled on the chart) seen since last October. Cutting to the chase, this is the very definition of an uptrend.

This is clearly good news as investors came into 2023 braced for the worst as sentiment was nothing short of dour with just about everybody on the planet expecting the Fed to make a mistake and for stock prices to “price in” a hard landing.

However, it is important to understand the any trend – up or down – tends to move in a stairstep fashion. Two steps forward and one step back, if you will. This too is illustrated on chart above.

So, we shouldn’t be too surprised if the market breaks down hard (on a hot CPI report, maybe?) in the near-term to “test” the uptrend line. As such, we might expect to see the S&P test the 3970 – 4000 in the next week or so. Also note that both the 50-day and 200-day moving averages currently resides in this area, marking a technically important zone to watch closely.

Should the bears prevail with lower prices, the next key line in the sand is the 3745 area, which is the previous low. As long as that low “holds,” then our heroes in horns will argue that the trend is still up and that they are in control the game.

But… If the bulls fail to hold this line in the sand on any downside assault, one can argue that the uptrend has now ended, and a test of the October low is “on.”

Next, let’s take a peek at the longer-term picture via a weekly chart.

S&P 500 Weekly

View Full Size Chart

As you can see, until just recently, the market had been entrenched in a downtrend. As we discussed above, the series of lower highs and lower lows provides the textbook definition of a downtrend.

However, there is some good news here as well as the downtrend has been “broken” by the bulls’ most recent joyride to the upside. Which is a good thing.

Although the bulls would like nothing better than to continue the current rally for a while, a pullback is to be expected. And as we highlighted on the daily chart, the key for the bulls is to keep those “higher highs and higher lows” coming. So, as long as the S&P can stay above 3830(ish), the uptrend will remain intact.

So, there you have it. From my seat, it is important to remember that market trends ebb and flow and that “countertrend moves” are to be expected.

The question is how one approaches these “go the other way” type moves. For example, if your longer-term view is positive, you may want to buy/add every time the market “dips.” Conversely, if you are currently sporting your bear cap, then you will want to sell the rallies and await “lower lows” ahead.

In my humble opinion, this is what the game is all about at this time. If inflation trends down – at the appropriate rate – the bulls are likely to retain possession of the ball. But if not, well, it’ll be time to watch those key lines in the sand.

Now let’s review the “state of the market” through the lens of our market models…

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Key Price Levels

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Regardless of the color on the screens, try embracing an “attitude of gratitude” today…

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

none

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives