On various calls with institutional clients over the past couple of weeks, I have summarized the current state of the market as an ongoing debate between the bulls and bears – playing out daily. I opined that the macro situation boils down to a series of questions. For example: Will the economy experience a hard or soft landing? Are we seeing a bank crisis or is there “nothing to see here?” Is a credit crunch looming, or not? Will the Fed pivot or make a mistake? And will the consumer (and in turn, earnings) remain resilient or is a serious pullback in economic activity beginning to occur?

My primary point has been that the markets are in the process of working through these various questions/issues. Both teams have agruments – good arguments. And I have provided both sides of each recently – often with nearly equal fervor.

However, as I have opined in this space a time or twenty over the years, I believe markets can “handle” just about anything given enough data and time. And from my perch, the current market is a good example of this concept.

Bad News Abounds

To be sure, markets have had a fair amount of “bad news” thrown at them so far this year. There is the making of (or as the bears contend, the beginnings of) a bank crisis, the surprisingly sticky CPI reports, the weakening economic data, the geopolitical messes, and the nearly daily dose of uber-hawkish Fedspeak. Yet through it all, the markets have held up, dare I say it; pretty darn well.

So Far, So Good

For those of you keeping score at home, a classic 60/40 portfolio (60% S&P 500 and 40% Barclays Aggregate Bond indices), which tends to be widely used by financial advisors as a base-level, moderate growth-oriented investment management approach, has returned +5.71% (using SPY and AGG as proxies). Not bad, right?

Looking around further, we find the S&P 500 (SPY) is up +7.85% as of Friday’s close and the NASDAQ 100 (QQQ), which was smoked for a loss of more than -33% last year, sports a gain of nearly +20% on the year (+19.64% to be exact). As such, I think it is safe to say that the markets aren’t exactly freaking out right now.

Bears Remain Steadfast

Of course, our furry friends in the bear camp continue to predict – early, often, and quite loudly, I might add – that we should ignore all the good stuff happening in the markets and simply accept the fact that the sky is indeed about to fall (and this time, they mean it!).

Those seeing the market’s glass as at least half-empty espouse that earnings are about to crater, that the banking crisis is just getting started, that a “credit crunch” is sure to ensue, that valuations are huge problem, that the Fed is about to make a massive mistake, that a severe recession is about to begin, and that stock prices must revisit, if not break, the lows of last year. In short, the battle cry is: Worry, worry, worry!

On One Hand…

As any two-handed analyst worth their salt, I too recognize that the economy could very well wind up in recession at some point. I see the data come in every single day. And there is no denying that things are slowing down. Heck, even the Fed admits that a mild recession looks likely.

Yet, On the Other…

But here’s the thing. IF (note the use of all caps) the economy does wind up in a downturn, it will be the most predicted/anticipated event in economic history. I.E. There has been ample time for the market to “discount” the upcoming big, bad, event as the market has been “dealing” with this dire economic forecast for over a year now. And for the record, it hasn’t happened.

Nor does it look like the economy is in recession right now. Exhibit A here is the Atlanta Fed’s GDPNow forecast, which updates the components of GDP in real-time. The latest reading, which was updated on Friday says that the economy is currently growing at a rate of 2.5%. So, with the unemployment rate still at/near historic lows, I personally have a hard time getting into fear-mongering mode here.

The Fed is #Winning

Sure, the economy looks like it’s slowing down. But remember fans, this is EXACTLY what the Fed wants. And that banking crisis? Yep, you guessed it; this also helps the Fed achieve its goals by (a) reducing access to credit, (b) scaring consumers, and (c) slowing money supply.

Yes, I know, this is part of the bear camp’s argument. But I ask you; what do you think the Fed will do once (a) they get what they want on the inflation front or (b) things start to “break” in earnest. Oh, that’s right, they will start cutting rates. Just like they always do. Which, of course, has historically been a good thing for investors. You do remember that, right?

Cutting To The Chase

I could go on, and on, and on. But as this missive has likely meandered enough already, let’s cut to the chase. For me, the bottom line is longer-term investors need to take a stand on “the debate” and invest accordingly.

If you think the sky is about to rain cats and dogs on the markets, by all means, take cover. And if you believe that things are going to be okay, you should pick your spots (preferably on those volatile down days) and add to your positions – over time, of course.

For now, that’s my story and I’m sticking to it. Unless (you knew that was coming, right?) the macro picture changes in a meaningful way. If it does, my plan, as always, will be to adjust accordingly (which, as a tactical risk-manager has been my modus operandi since 1987).

P.S. I would like to extend a sincere “thank you” to all those that sent sympathies regarding my Achilles tear. As an update, the surgery went well and I’m on the (long-ish) road to recovery. The good news for readers of my oftentimes meandering market missive is since I can do very little on crutches, I should have plenty of time to opine on the markets over the next six weeks!

Now let’s review the “state of the market” through the lens of our market models…

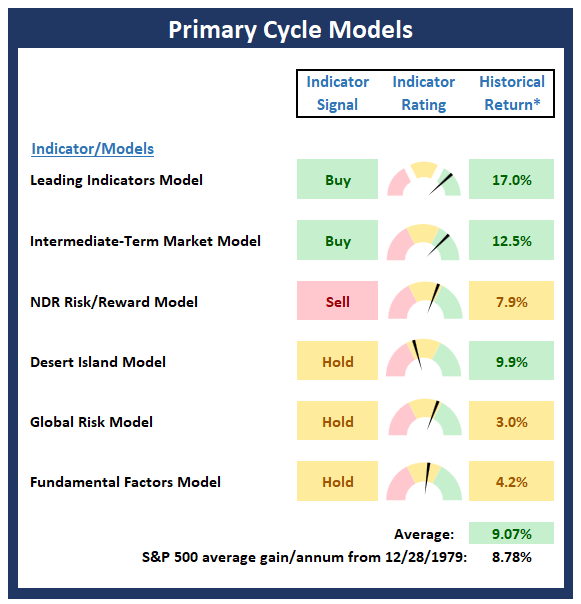

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

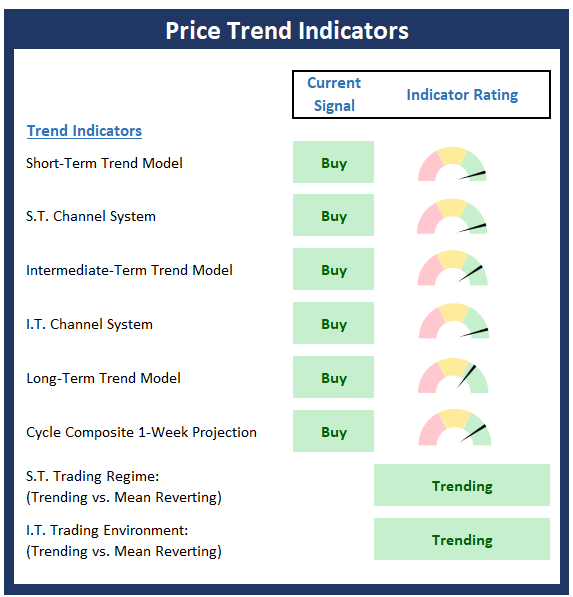

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

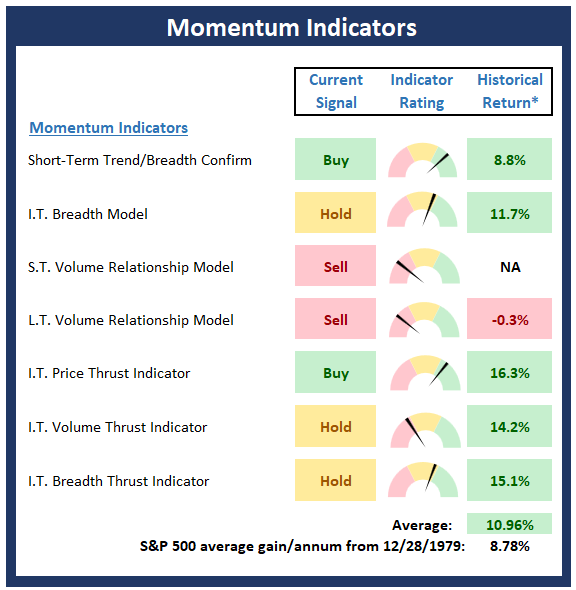

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

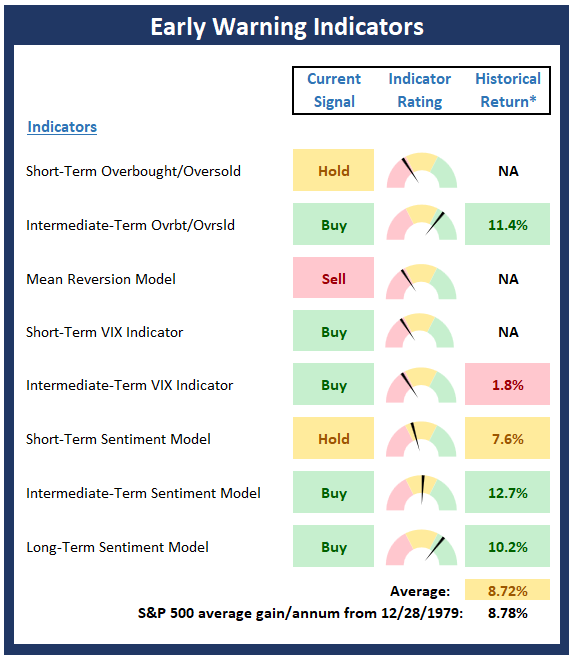

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

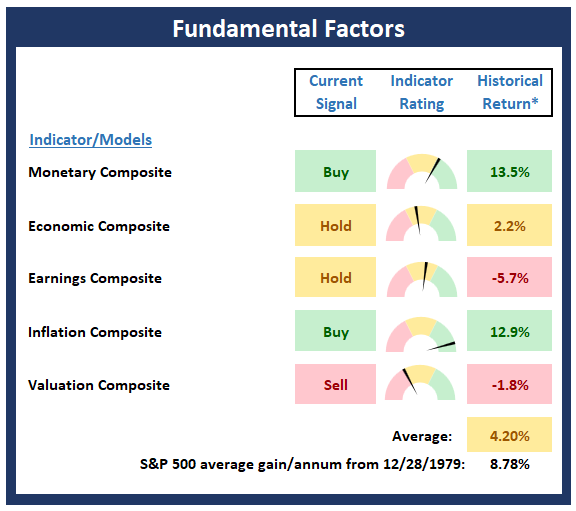

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Keep in mind that not every person’s opinion is worthy of your attention -Unknown

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

SPY, AGG, QQQ

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

Institutional Consulting

David Moenning

The Debate is On

On various calls with institutional clients over the past couple of weeks, I have summarized the current state of the market as an ongoing debate between the bulls and bears – playing out daily. I opined that the macro situation boils down to a series of questions. For example: Will the economy experience a hard or soft landing? Are we seeing a bank crisis or is there “nothing to see here?” Is a credit crunch looming, or not? Will the Fed pivot or make a mistake? And will the consumer (and in turn, earnings) remain resilient or is a serious pullback in economic activity beginning to occur?

My primary point has been that the markets are in the process of working through these various questions/issues. Both teams have agruments – good arguments. And I have provided both sides of each recently – often with nearly equal fervor.

However, as I have opined in this space a time or twenty over the years, I believe markets can “handle” just about anything given enough data and time. And from my perch, the current market is a good example of this concept.

Bad News Abounds

To be sure, markets have had a fair amount of “bad news” thrown at them so far this year. There is the making of (or as the bears contend, the beginnings of) a bank crisis, the surprisingly sticky CPI reports, the weakening economic data, the geopolitical messes, and the nearly daily dose of uber-hawkish Fedspeak. Yet through it all, the markets have held up, dare I say it; pretty darn well.

So Far, So Good

For those of you keeping score at home, a classic 60/40 portfolio (60% S&P 500 and 40% Barclays Aggregate Bond indices), which tends to be widely used by financial advisors as a base-level, moderate growth-oriented investment management approach, has returned +5.71% (using SPY and AGG as proxies). Not bad, right?

Looking around further, we find the S&P 500 (SPY) is up +7.85% as of Friday’s close and the NASDAQ 100 (QQQ), which was smoked for a loss of more than -33% last year, sports a gain of nearly +20% on the year (+19.64% to be exact). As such, I think it is safe to say that the markets aren’t exactly freaking out right now.

Bears Remain Steadfast

Of course, our furry friends in the bear camp continue to predict – early, often, and quite loudly, I might add – that we should ignore all the good stuff happening in the markets and simply accept the fact that the sky is indeed about to fall (and this time, they mean it!).

Those seeing the market’s glass as at least half-empty espouse that earnings are about to crater, that the banking crisis is just getting started, that a “credit crunch” is sure to ensue, that valuations are huge problem, that the Fed is about to make a massive mistake, that a severe recession is about to begin, and that stock prices must revisit, if not break, the lows of last year. In short, the battle cry is: Worry, worry, worry!

On One Hand…

As any two-handed analyst worth their salt, I too recognize that the economy could very well wind up in recession at some point. I see the data come in every single day. And there is no denying that things are slowing down. Heck, even the Fed admits that a mild recession looks likely.

Yet, On the Other…

But here’s the thing. IF (note the use of all caps) the economy does wind up in a downturn, it will be the most predicted/anticipated event in economic history. I.E. There has been ample time for the market to “discount” the upcoming big, bad, event as the market has been “dealing” with this dire economic forecast for over a year now. And for the record, it hasn’t happened.

Nor does it look like the economy is in recession right now. Exhibit A here is the Atlanta Fed’s GDPNow forecast, which updates the components of GDP in real-time. The latest reading, which was updated on Friday says that the economy is currently growing at a rate of 2.5%. So, with the unemployment rate still at/near historic lows, I personally have a hard time getting into fear-mongering mode here.

The Fed is #Winning

Sure, the economy looks like it’s slowing down. But remember fans, this is EXACTLY what the Fed wants. And that banking crisis? Yep, you guessed it; this also helps the Fed achieve its goals by (a) reducing access to credit, (b) scaring consumers, and (c) slowing money supply.

Yes, I know, this is part of the bear camp’s argument. But I ask you; what do you think the Fed will do once (a) they get what they want on the inflation front or (b) things start to “break” in earnest. Oh, that’s right, they will start cutting rates. Just like they always do. Which, of course, has historically been a good thing for investors. You do remember that, right?

Cutting To The Chase

I could go on, and on, and on. But as this missive has likely meandered enough already, let’s cut to the chase. For me, the bottom line is longer-term investors need to take a stand on “the debate” and invest accordingly.

If you think the sky is about to rain cats and dogs on the markets, by all means, take cover. And if you believe that things are going to be okay, you should pick your spots (preferably on those volatile down days) and add to your positions – over time, of course.

For now, that’s my story and I’m sticking to it. Unless (you knew that was coming, right?) the macro picture changes in a meaningful way. If it does, my plan, as always, will be to adjust accordingly (which, as a tactical risk-manager has been my modus operandi since 1987).

P.S. I would like to extend a sincere “thank you” to all those that sent sympathies regarding my Achilles tear. As an update, the surgery went well and I’m on the (long-ish) road to recovery. The good news for readers of my oftentimes meandering market missive is since I can do very little on crutches, I should have plenty of time to opine on the markets over the next six weeks!

Now let’s review the “state of the market” through the lens of our market models…

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Keep in mind that not every person’s opinion is worthy of your attention -Unknown

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

SPY, AGG, QQQ

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing, Federal Reserve, Inflation, Rate Hikes, Fed, Jerome Powell

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives