The State of the Market

Long-time readers know that the primary purpose of my oftentimes meandering market missive is to identify the drivers of the current market environment. And since I spent a fair part of the weekend dodging blizzards on our way to Palm Desert, CA, I’m going to stick to that plan on this fine Monday morning. So, below are what I see as the key factors impacting Ms. Market’s game at the present time.

From a big-picture perspective, I see the primary driver being the economic outlook. While there are lots of other things for traders to focus on during any given session, the real key is the fact that the economy is looking good. In fact, many economists are calling for an economic “boom” to occur in the coming months. Which, of course, is a good thing.

As I’ve noted previously, the economic data have been coming in better than expected. And with more than 100 million shots in the arms of U.S. citizens as of this morning, lots of folks are looking ahead to a return to at least some form of normalcy. Now stir in a couple trillion dollars of economic relief and more stimulus plans in the mix, and well, a “booming” economy seems like a real possibility. And since earnings growth tends to follow hand-in-hand with economic growth, the table appears to be set for the bulls.

Another plus for the stock market here is an uber-friendly group of central bankers. Between Jay Powell suggesting that the Fed “isn’t even thinking about thinking about” raising rates – at least until the economy returns to full employment – and the ECB pledging to up their bond-buying efforts last week, we must recognize that the monetary backdrop remains positive. Yes, at some point, the world’s central bankers may try to back away from this position. But for now at least, it is probably best to avoid fighting the Fed.

Next up is the outlook for earnings growth. Cutting to the chase, Wall Street analysts have been busy upping their estimates for earnings in the coming quarters. And it follows that higher earnings means that prices can increase without impacting valuations.

Speaking of valuations, there can be little argument that standard metrics suggest a richly valued stock market. However, when you consider (a) the level of interest rates and (b) the fact that valuations tend to soar when the economy exits a recession, I feel this worry can be set aside for a while – as long as the anticipated earnings show up at some point, of course.

Another potential concern for traders is the recent rise in interest rates. Although we can argue that rates are “higher, but not high,” the recent rate of ascent has caused traders to rethink their view of high growth/PE stocks. As such, the fast money has been busy rotating out of the high priced COVID winners and into the areas that should benefit from a return to economic normalcy – aka the “reopening trade.”

Inflation has also been an issue bandied about a bit lately. However, with Powell and others using words like “transitory” and “temporary” to describe the current rise in inflation expectations, I think the phrase “higher, not high” can also be applied to this subject.

So… From my seat, it appears that the primary drivers of stock prices can be viewed as constructive. As such, I think a “buy the dips” approach still makes sense.

Have a great week! Now let’s turn to our expanded weekly model update…

Weekly Model Review

Each week we do a deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay “in tune” with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

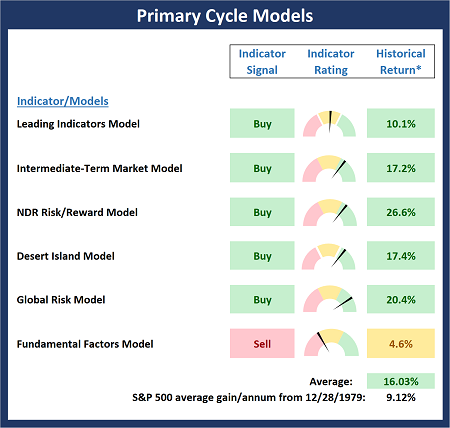

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

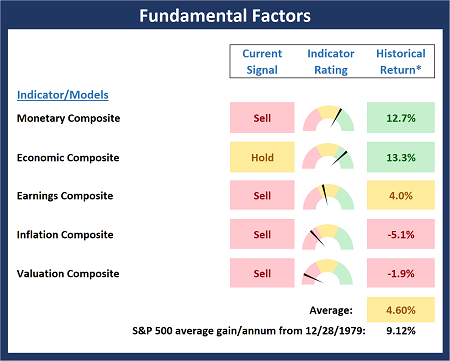

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

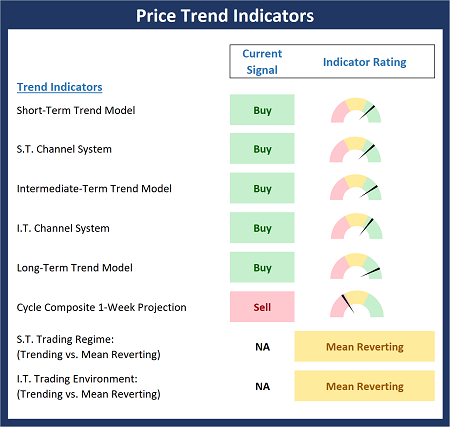

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

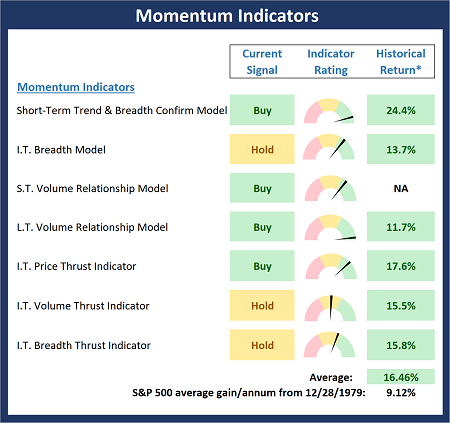

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Signals

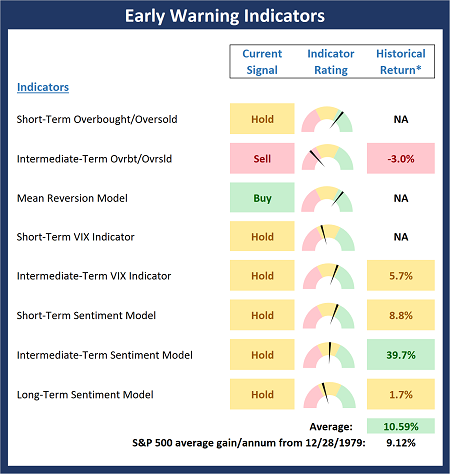

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Market Models Explained

Thought for the Day:

Do not be afraid of mistakes, providing you do not make the same one twice. -Eleanor Roosevelt

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

Institutional Consulting

David Moenning

Backdrop Remains Constructive

The State of the Market

Long-time readers know that the primary purpose of my oftentimes meandering market missive is to identify the drivers of the current market environment. And since I spent a fair part of the weekend dodging blizzards on our way to Palm Desert, CA, I’m going to stick to that plan on this fine Monday morning. So, below are what I see as the key factors impacting Ms. Market’s game at the present time.

From a big-picture perspective, I see the primary driver being the economic outlook. While there are lots of other things for traders to focus on during any given session, the real key is the fact that the economy is looking good. In fact, many economists are calling for an economic “boom” to occur in the coming months. Which, of course, is a good thing.

As I’ve noted previously, the economic data have been coming in better than expected. And with more than 100 million shots in the arms of U.S. citizens as of this morning, lots of folks are looking ahead to a return to at least some form of normalcy. Now stir in a couple trillion dollars of economic relief and more stimulus plans in the mix, and well, a “booming” economy seems like a real possibility. And since earnings growth tends to follow hand-in-hand with economic growth, the table appears to be set for the bulls.

Another plus for the stock market here is an uber-friendly group of central bankers. Between Jay Powell suggesting that the Fed “isn’t even thinking about thinking about” raising rates – at least until the economy returns to full employment – and the ECB pledging to up their bond-buying efforts last week, we must recognize that the monetary backdrop remains positive. Yes, at some point, the world’s central bankers may try to back away from this position. But for now at least, it is probably best to avoid fighting the Fed.

Next up is the outlook for earnings growth. Cutting to the chase, Wall Street analysts have been busy upping their estimates for earnings in the coming quarters. And it follows that higher earnings means that prices can increase without impacting valuations.

Speaking of valuations, there can be little argument that standard metrics suggest a richly valued stock market. However, when you consider (a) the level of interest rates and (b) the fact that valuations tend to soar when the economy exits a recession, I feel this worry can be set aside for a while – as long as the anticipated earnings show up at some point, of course.

Another potential concern for traders is the recent rise in interest rates. Although we can argue that rates are “higher, but not high,” the recent rate of ascent has caused traders to rethink their view of high growth/PE stocks. As such, the fast money has been busy rotating out of the high priced COVID winners and into the areas that should benefit from a return to economic normalcy – aka the “reopening trade.”

Inflation has also been an issue bandied about a bit lately. However, with Powell and others using words like “transitory” and “temporary” to describe the current rise in inflation expectations, I think the phrase “higher, not high” can also be applied to this subject.

So… From my seat, it appears that the primary drivers of stock prices can be viewed as constructive. As such, I think a “buy the dips” approach still makes sense.

Have a great week! Now let’s turn to our expanded weekly model update…

Weekly Model Review

Each week we do a deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay “in tune” with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The Fundamental Backdrop

Next, we review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any “oomph” behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Early Warning Signals

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Market Models Explained

Thought for the Day:

Do not be afraid of mistakes, providing you do not make the same one twice. -Eleanor Roosevelt

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director Institutional Consulting

Capital Advisors 360, LLC

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

None

– Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES

Tags: David Moenning, State of the Markets, Stock Market, Stocks, Stock Market Commentary, Stock Market Analysis, Investing

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives