The State of the Market: Executive Summary

If you are like me, you were probably checking on the stock market futures in the wee hours of Tuesday night/Wednesday morning. If you are also like me, you may have been surprised initially to see the NDX futures popping 3% higher. And if you are like me, you likely wondered if the move would hold up into this morning’s open. After all, the election remains undecided and there is sure to be some political maneuvering/hand wringing happening in the days ahead.

It turns out the move did indeed hold up into the open this morning. At 8:00 am mountain time, the S&P is currently trading higher by +1.9%, the QQQ’s are up +3.3%, while the Russell 2000 Small Caps (IWM is a proxy) is losing -0.3% as I type. Interesting action, right? Apparently more than a few folks are befuddled here as I have received a handful of texts and emails on the subject.

So, here’s my take. Upon reflection, the early move certainly makes sense. Sure, the Presidential election outcome is unclear. Sure, it could go either way. And yes, it may take a while to know the results. But from my seat, the market move isn’t about the occupant of the White House for the next four years.

I think the real key is the market is assuming that the “blue wave” (i.e. the Democrats taking control of both the White House and the Senate) doesn’t look likely to happen.

My take is that from the market’s perspective, this means that (a) corporate income and capital taxes aren’t likely to reach the levels projected by Biden’s plan, (b) a financial transactions tax won’t happen, (c) the “break up big tech” movement will be slowed, if not eliminated (hence the surges seen this morning in the FAMANG names (FB, AMZN, MSFT, AAPL, NFLX, and GOOGL), (d) the GOP’s de-regulation movement will continue, and (e) the amount of stimulus/deficit spending/debt will be lower than if a Democratic sweep had occurred.

Exhibit B in my argument here is the action in the 10-year. In short, yields are plunging this morning, with the 10-year yield currently trading down -13.8% so far today. The reason would appear to be straightforward. No “blue wave” means a smaller stimulus package. Which, to bond traders, means less supply of new bonds. And to a lesser degree, maybe even a little less inflation pressure down the road.

Exhibit C is the action in the small caps, which have become a proxy for “the recovery trade.” Why would “the recovery trade” suffer with all of the macro positives listed above, you ask? Two things, really. First, less stimulus means a weaker economic recovery (or put another way, less “juicing” of the economy) in the near-term. And second, falling rates means less profitability for the banks, which are a big part of the small cap indices. Exhibit D would be the fact that the BKX is off -3.6% this morning. And while not deserving of its own “Exhibit,” I will also note that energy is rallying today.

So, personal politics aside, this is my take on why Ms. Market is in a good mood this morning. The question, of course, is if it will continue!

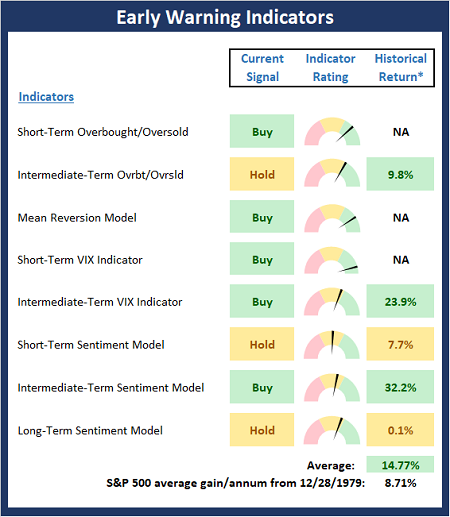

Now let’s take a look at what our Early Warning indicator board tells us about the near-term outlook…

The State of the “Early Warning” Indicators

To be fair, I am not doing the Early Warning board justice by only publishing it once a week. You see, the board can change quickly and the “signals” it provides tend to be short-term. For example, the board currently sports a healthy shade of green. As such, you may be inclined to think that this is a signal to get long(er). However, it is important to recognize that the “signals” to get long(er) came Tuesday morning – which, so far at least, appears to have been pretty timely. The next question is if the bulls can get something going and push our board into an overbought condition. And from there, our heroes in horns will likely try to convert the overbought mode into a “good overbought” situation. Yes, I’m probably getting ahead of myself here. But all of the above would support/coincide with the traditional post-election/year-end rally. So, siding with the bulls for a bit makes some sense.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Stochastic Review

The stochastics are a great example of “mean reversion” trading strategy. When the market gets oversold and then reverses (illustrated by the blue line in the lower clip crossing above the red line – after the blue line falls below the lower dashed line) – a buy signal is triggered. To be clear, this is a very short-term “trading” strategy designed to buy low and sell high. However, it doesn’t work all the time and can be downright useless when a market is “trending” in one direction or the other. But for those times when the market is stuck in a sideways, consolidation mode, having a strategy to “ride the range” can be a way for traders to add some value/alpha.

S&P 500 – Daily

View Large Chart Online

Thought For The Day:

Faith is taking the first step even when you don’t see the whole staircase. – Martin Luther King Jr.

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director of Institutional Consulting

Capital Advisors 360, LLC

Disclosures — Past performances do not guarantee future results or profitability. At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

FB, AMZN, MSFT, AAPL, NFLX, QQQ, IWM — please note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. Important further disclosures and model explanations.

Institutional Consulting

David Moenning

Stocks May Not Care Who Wins The White House

The State of the Market: Executive Summary

If you are like me, you were probably checking on the stock market futures in the wee hours of Tuesday night/Wednesday morning. If you are also like me, you may have been surprised initially to see the NDX futures popping 3% higher. And if you are like me, you likely wondered if the move would hold up into this morning’s open. After all, the election remains undecided and there is sure to be some political maneuvering/hand wringing happening in the days ahead.

It turns out the move did indeed hold up into the open this morning. At 8:00 am mountain time, the S&P is currently trading higher by +1.9%, the QQQ’s are up +3.3%, while the Russell 2000 Small Caps (IWM is a proxy) is losing -0.3% as I type. Interesting action, right? Apparently more than a few folks are befuddled here as I have received a handful of texts and emails on the subject.

So, here’s my take. Upon reflection, the early move certainly makes sense. Sure, the Presidential election outcome is unclear. Sure, it could go either way. And yes, it may take a while to know the results. But from my seat, the market move isn’t about the occupant of the White House for the next four years.

I think the real key is the market is assuming that the “blue wave” (i.e. the Democrats taking control of both the White House and the Senate) doesn’t look likely to happen.

My take is that from the market’s perspective, this means that (a) corporate income and capital taxes aren’t likely to reach the levels projected by Biden’s plan, (b) a financial transactions tax won’t happen, (c) the “break up big tech” movement will be slowed, if not eliminated (hence the surges seen this morning in the FAMANG names (FB, AMZN, MSFT, AAPL, NFLX, and GOOGL), (d) the GOP’s de-regulation movement will continue, and (e) the amount of stimulus/deficit spending/debt will be lower than if a Democratic sweep had occurred.

Exhibit B in my argument here is the action in the 10-year. In short, yields are plunging this morning, with the 10-year yield currently trading down -13.8% so far today. The reason would appear to be straightforward. No “blue wave” means a smaller stimulus package. Which, to bond traders, means less supply of new bonds. And to a lesser degree, maybe even a little less inflation pressure down the road.

Exhibit C is the action in the small caps, which have become a proxy for “the recovery trade.” Why would “the recovery trade” suffer with all of the macro positives listed above, you ask? Two things, really. First, less stimulus means a weaker economic recovery (or put another way, less “juicing” of the economy) in the near-term. And second, falling rates means less profitability for the banks, which are a big part of the small cap indices. Exhibit D would be the fact that the BKX is off -3.6% this morning. And while not deserving of its own “Exhibit,” I will also note that energy is rallying today.

So, personal politics aside, this is my take on why Ms. Market is in a good mood this morning. The question, of course, is if it will continue!

Now let’s take a look at what our Early Warning indicator board tells us about the near-term outlook…

The State of the “Early Warning” Indicators

To be fair, I am not doing the Early Warning board justice by only publishing it once a week. You see, the board can change quickly and the “signals” it provides tend to be short-term. For example, the board currently sports a healthy shade of green. As such, you may be inclined to think that this is a signal to get long(er). However, it is important to recognize that the “signals” to get long(er) came Tuesday morning – which, so far at least, appears to have been pretty timely. The next question is if the bulls can get something going and push our board into an overbought condition. And from there, our heroes in horns will likely try to convert the overbought mode into a “good overbought” situation. Yes, I’m probably getting ahead of myself here. But all of the above would support/coincide with the traditional post-election/year-end rally. So, siding with the bulls for a bit makes some sense.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Stochastic Review

The stochastics are a great example of “mean reversion” trading strategy. When the market gets oversold and then reverses (illustrated by the blue line in the lower clip crossing above the red line – after the blue line falls below the lower dashed line) – a buy signal is triggered. To be clear, this is a very short-term “trading” strategy designed to buy low and sell high. However, it doesn’t work all the time and can be downright useless when a market is “trending” in one direction or the other. But for those times when the market is stuck in a sideways, consolidation mode, having a strategy to “ride the range” can be a way for traders to add some value/alpha.

S&P 500 – Daily

View Large Chart Online

Thought For The Day:

Faith is taking the first step even when you don’t see the whole staircase. – Martin Luther King Jr.

Market Models Explained

Wishing you green screens and all the best for a great day,

David D. Moenning

Director of Institutional Consulting

Capital Advisors 360, LLC

Disclosures — Past performances do not guarantee future results or profitability. At the time of publication, Mr. Moenning held long positions in the following securities mentioned:

FB, AMZN, MSFT, AAPL, NFLX, QQQ, IWM — please note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. Important further disclosures and model explanations.

RECENT ARTICLES

The Time Has Come

The Market Panic Playbook

Bears Get Back In The Game

Sell in May, Except…

When Being Completely Wrong Works Out

Stronger For Longer?

Archives

Archives